American tech companies’ wings were clipped yesterday. Nasdaq100 index, which at the beginning of trading in the U.S. exceeded 11000, ended the day with a 4% decline from the peak levels. The situation, which developed at exceptionally high speeds in recent days, was similar to the profit taking seen in the previous multi-month rally.

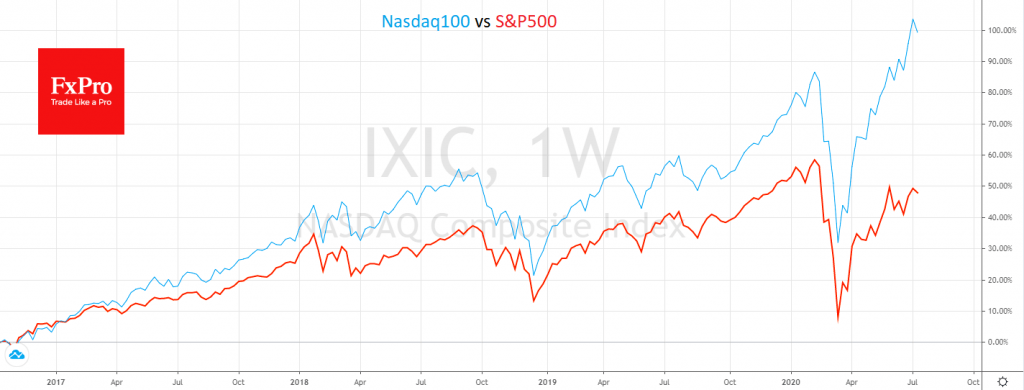

Tech companies and “growth companies” in general have been pulling up indices since late March, raising Nasdaq by 66%. Apple almost doubled in price, going from 212 to 400 and some brands showed even more impressive results. For example, the capitalization of Tesla took off more than five times since then, raising the stock price to almost $1,800 from $350.

Such abnormal growth led to a situation where quotes simply fell under their own weight. After reaching the round levels that serve as a trigger to start taking-profit, the dynamic quickly gained momentum.

It is interesting that no serious movements were noticed in adjacent markets. S&P500 has lost 0.9%: in many respects, this is a consequence of the weight of the IT companies within it. Dow Jones closed Monday with 0% change, and on the currency market, there was a small bias against the dollar, which is often positive for stocks.

This is not the first time in modern history when high-tech companies led the growth of markets and then pulled them down during the correction period. In 2018, Nasdaq’s slippage resulted in a correction of the entire market in the following weeks, resulting in a large sell-off at the end of that year.

Earlier we surmised that the current rally is mainly due to the interest of retailers. They tend to choose stocks in the portfolio not so much on the basis of multipliers and reporting, but on the basis of previous growth history. As in the case of the crypto market in 2017, with no new peaks, there is a risk of investor attitudes quickly reversing, resulting in a deep sell-off of recent leaders in growth, almost like a reverse bubble.

The FxPro Analyst Team