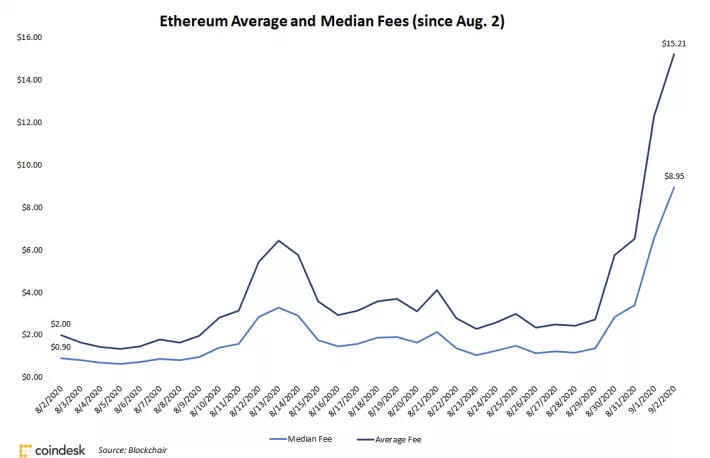

The surge in fees is being driven by the explosive popularity of decentralized finance (DeFi) applications that are predominantly built on Ethereum. Average network fees reached $15.21 on Wednesday, up 660% from $2 a month ago. Ethereum’s median fees also spiked nearly 900% over the same period, reaching $8.95.

Moreover, the day after CoinDesk reported about new record highs Tuesday for transaction costs, average fees climbed another 24% and median fees spiked 37 percent. In a bid to ameliorate soaring fees, Ethereum co-founder Vitalik Buterin released his Ethereum Improvement Proposal (EIP) 2929 Tuesday that proposes making certain heavy contracts more expensive by a factor of three. Contracts affected would be those that update the Ethereum state, including some applications.

This repricing proposal could break some smart contracts already operating on Ethereum, Buterin wrote. He added that developers “have had years of warning” about potential changes. Approving this proposal, however, requires consensus from the Ethereum community, a process that can take weeks or months. Other broad-brush scaling solutions like EIP 1559 or sharding remain on the distant horizon as well.

Buterin, Ethereum Developers Focus on Congestion as Fees Spike Over 600% in 1 Month, CoinDesk, Sep 3