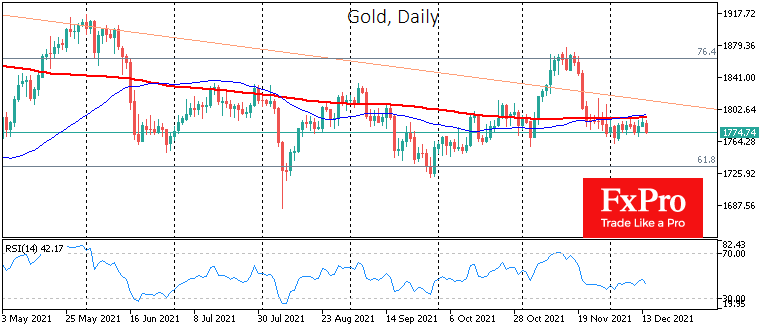

Gold has remained aloof from the main market movements since the beginning of the month, hovering in a range of no more than 1.5% over the last two weeks and alternating between rising and falling.

The trend so far this month suggests cautious buying on the intraday lows from a bit higher level. This is a continuation of the upward trend of the local lows that we have seen since March of this year.

On the other hand, the local initiative remains on the side of the bears, who are pushing the gold price sideways on the slightest attempt of rising into the area of crossing the 50- and 200-day moving averages. A pullback above $1790 will give a strong bullish signal, the so-called “golden cross”, and it might test the resistance of the bearish trend from August last year.

The current week, excessively busy with key central bank meetings led by the Fed, promises to take gold out of the equilibrium. In theory, the tightening of central bank rhetoric (accelerating tapering, approaching rate hike date) is a negative for gold. In practice, however, it is worth remembering that gold has remained under pressure precisely on expectations of a tight Fed and company response to inflation. In addition, it is worth remembering that the multi-year bearish trend in gold ended in 2015 on the day of the first Fed rate hike after the financial crisis.

Although bears generally retain control of the market, bulls are pulling their support higher and are increasingly attempting the downtrend of the last 16 months.

The FxPro Analyst Team