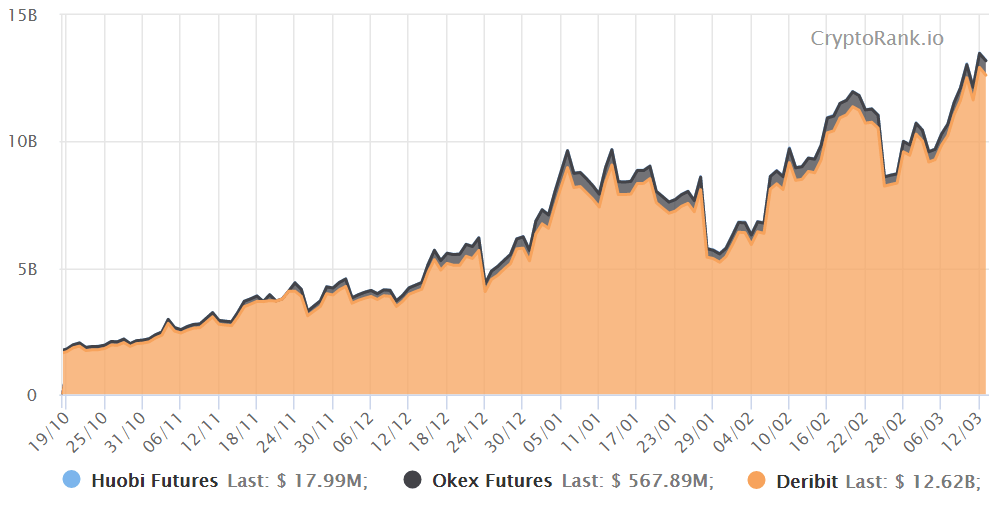

Over the past two months, the open interest on Bitcoin options increased by 60% to reach $13.5 billion as the BTC price rose to a new all-time high. The result of Bitcoin’s price appreciation and the rising options open interest resulted in a potentially historic $6.1 billion expiry set for March 26. Most exchanges offer monthly exposures, although a few also hold weekly options for short-term contracts. Jan. 29, 2020, had the largest expiry on record as $3.5 billion worth of option contracts expired. This figure represented 36% of all open interest at that time.

The above data shows that Bitcoin’s March 26 expiry holds 100,400 BTC. That unusual concentration translates to 45% of its contracts set to expire in eleven days. It is worth noting that not every option will trade at expiry as some of those strikes now sound unreasonable, especially considering there are less than two weeks left. Unlike futures contracts, options are divided into two segments. Call (buy) options allow the buyer to acquire BTC at a fixed price on the expiry date. Generally speaking, those are used on either neutral arbitrage trades or bullish strategies. Meanwhile, the put (sell) options are commonly used as hedge or protection from negative price swings.

By excluding the neutral-to-bearish put options below $47,000 and the call options above $66,000, it is easier to estimate the potential impact of Friday’s expiry. Incentives to pump or dump the price by more than 17% become less likely, as the potential gains will seldom surpass the cost. This data leaves $1.13 billion worth of call options from $32,000 to $64,000 strikes for the aggregate options expiry on March 26. Meanwhile, the more bearish put options down to $47,000 amount to $462 million. Therefore, there’s a $668 million imbalance favoring the more bullish call options.

While a $6.1 billion options expiry could be worrisome, nearly 43% of them are already deemed worthless. As for the remaining open interest, bulls are mainly in control because the recent price hike to a new all-time high obliterated 84% of the bearish options. As expiry gets closer, a growing number of put options will lose their value if BTC remains above $52,000, increasing the advantage from the neutral-to-bullish call options.

Bulls favored ahead of record $6.1B Bitcoin options expiry on March 26, Cointelegraph, Mar 17