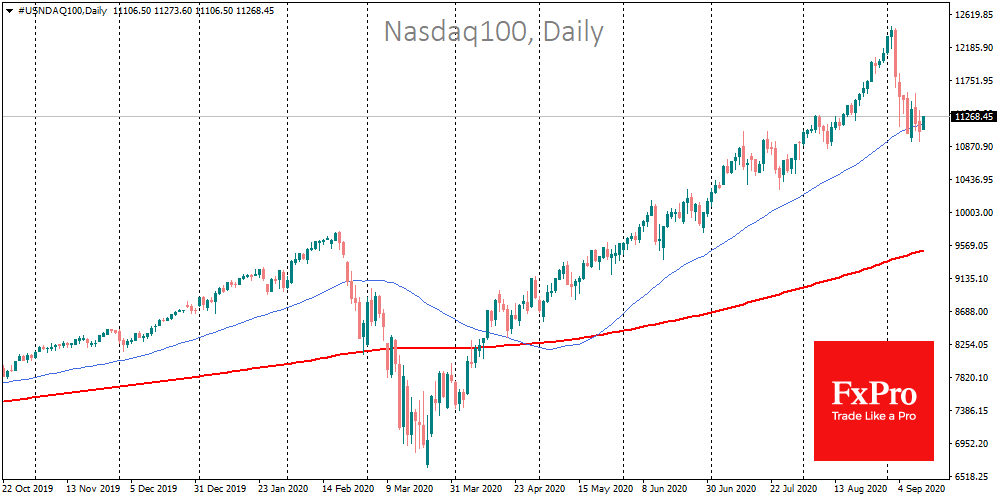

Global markets are experiencing some relief at the beginning of a new week. Pressure on the US indices has stopped approaching the 50-day average, which signifies this dip as technical and short term. The S&P 500 went below this line several times in one day last week, but each time it was eventually bought back. The Dow Jones also touched this mark, while Nasdaq has been hovering around its own since the beginning of last week.

The 50-day average failure in February was a preface to a sharp increase in pressure in the stock markets, and a stronger buying wave followed the return above this line. So this indicator has been doing a great job in recent months.

This time the dynamics around the 50-day average can be interpreted as moderately positive. Shares received support in the downturns, reflecting fundamentally high demand despite profit-taking.

Only if the Nasdaq100 falls below the 50-day average and the closes the day below 11,000, we can talk about stronger pressure. For S&P500, we will see a similar signal if the index slips below 3300.

At times like this, when the bull and bear scales look balanced, we often turn our attention to the dynamics of the foreign exchange market, and there are still some positive signals.

The USDCNH pair is trading around 6.83, halting its decline in September, but avoiding a correction rollback. This is an important sign of continued demand for risk assets from Asian investors. The dynamics of AUDUSD, which consolidates around 0.73, avoiding a corrective rollback after a month-long rally, tell us the same thing.

The Japanese yen and Swiss franc have been moving in a range since early August, with no signals that risk aversion is prevalent in the markets. EURUSD for the fourth consecutive trading session shows positive dynamics on the daily charts.

However, attempts by bulls to develop an offensive and return to the high area at 1.2000 are under pressure. The ability of EURUSD to catch up to 1.19000, combined with positive index movements, could serve as a strong bullish signal to markets and launch a new wave of buying.

Otherwise, the bulls could capitulate fairly quickly, rushing to be the first sellers in overheated markets before the decline becomes threatening.

The FxPro Analyst Team