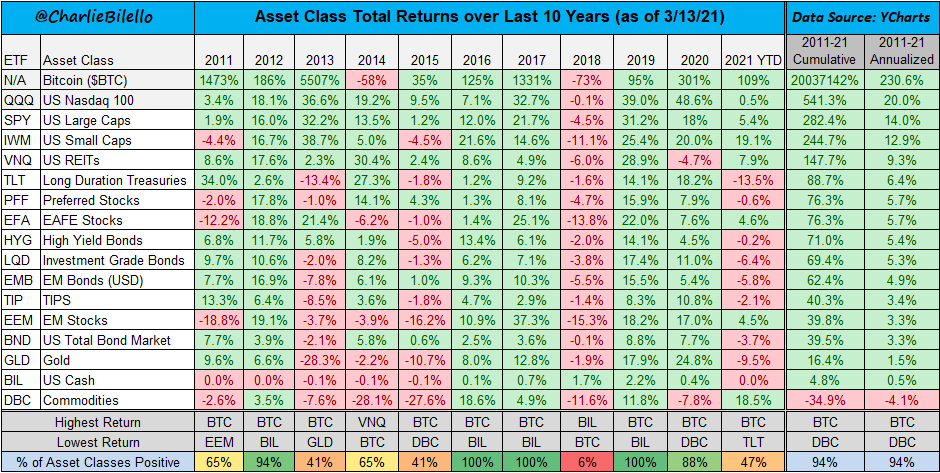

Over the past ten years, Bitcoin has beaten out all over asset classes by at least a factor of 10. The milestone was noted by Compound Capital Advisors’ CEO and founder, Charlie Bilello, who compiled the performances of the top asset classes using data from Ycharts.

Responding to the findings, Messari researcher Roberto Talamas highlighted that Bitcoin has produced an annualized return of 230% on average — more than 10 times higher than the second-ranked asset class. The U.S. Nasdaq 100 Index ranked second with an annualized return of 20%, followed by U.S. Large Caps — shares in U.S.-based companies with market caps exceeding $10 billion — with an average annual performance of 14%. U.S. Small Cap stocks were the only other asset class to post double-digit annualized returns for the past ten years, with 12.9%.

The data also shows that gold made a paltry annualized return of 1.5% since 2011, with five out of the past 11 years producing a loss for the asset. According to Gold Price, the precious metal has fallen by 8.5% since the beginning of 2021, much to the chagrin of Bitcoin detractor and gold investor Peter Schiff. Since 2011, BTC’s cumulative gains for BTC equate to a whopping 20 million percent. 2013 was Bitcoin’s best-performing year, during which it gained 5,507%.

BTC was best-performing asset of past decade by 900%, Cointelegraph, Mar 15