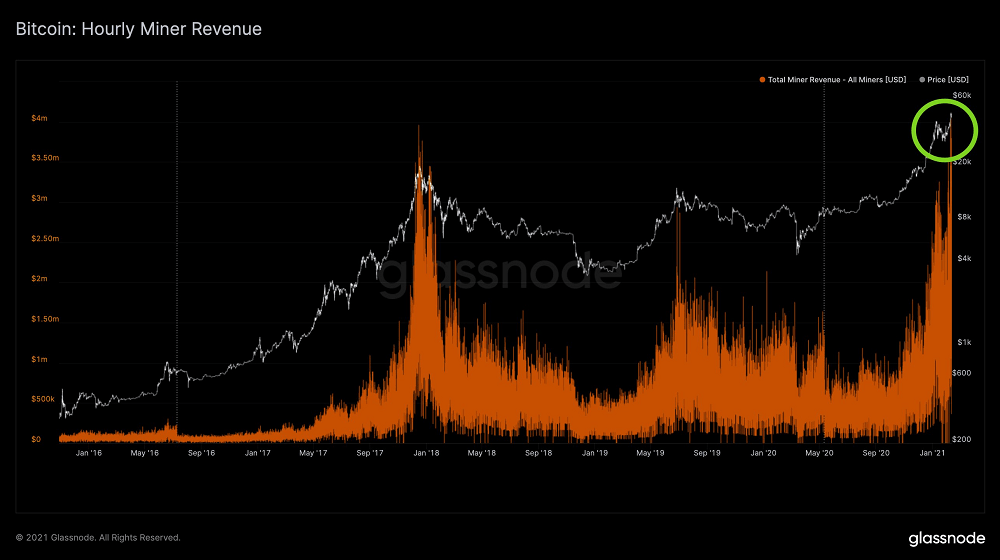

According to data from Glassnode, Bitcoin (BTC) miners made over $4 million in just under an hour on Feb. 12, making it the biggest hourly revenue in history. In May 2020, Bitcoin underwent the third block reward halving in its history, cutting the amount of new Bitcoin mined in half.

After a block reward halving, the amount of BTC miners can mine using computing power decreases by half. Hence, miner revenues decrease by 50% overnight, which could cause strain on mining operations in the short term. At the same time, the hash rate of the Bitcoin network is also at new all-time highs with the fourth consecutive upward difficulty adjustment by roughly 2.5% expected in seven days. A block reward halving occurs every four years to decrease the rate the remaining supply of Bitcoin is introduced to the market.

As Bitcoin nears its fixed supply at 21 million, the pace at which new BTC is mined is reduced through a halving. But the halving can put immense pressure on miners that depend on the BTC they mine to cover operational costs in the short term. Theoretically, when a halving occurs, the price of Bitcoin is expected to rise because of the lower supply of new coins entering the market. Therefore, a higher BTC price can make up for the lower number of BTC miners are rewarded with for mining a block.

This week, Bitcoin miners generated the biggest hourly revenue in history, despite mining half the BTC they used to mine compared to last year. This shows that Bitcoin is working as designed with its value increasing following the block reward halving, incentivizing miners to increase their hash rate and invest in the security of the network. Analysts at Glassnode said:

BTC miners pocket $4M in 60 minutes, the highest hourly revenue in Bitcoin’s history, Cointelegraph, Feb 12