Mining data aggregators attribute a slump in Bitcoin’s hash rate to the end of the wet season in Sichuan, resulting in many miners migrating to other jurisdictions. On Oct. 26, Thomas Heller of Bitcoin (BTC) mining blog Hashr8 reported that roughly 22 exahashes per second (EH/s) of mining power had left the Bitcoin network, coinciding with the end of the season the previous day (based on weather forecasts).

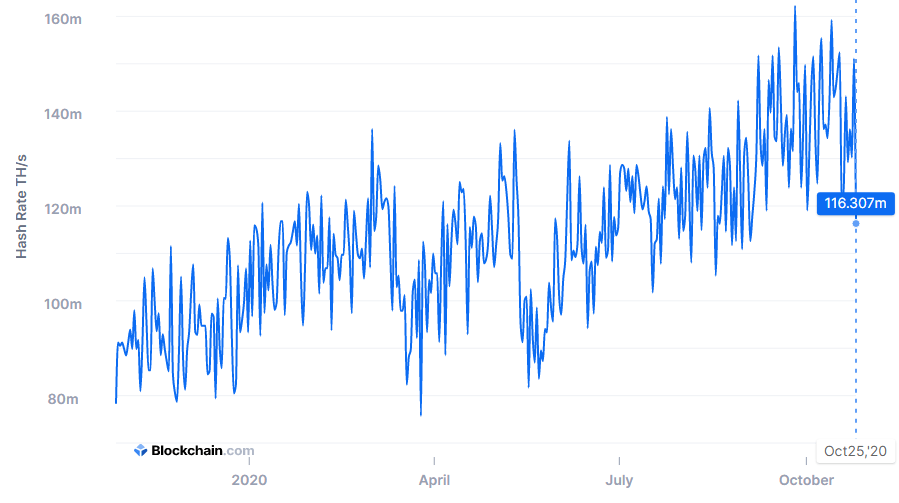

Kevin Zhang of mining-focused Digital Currency Group subsidiary Foundry also estimated a 20 EH/s drop, noting the seven-day average for Bitcoin’s hashrate was 132.9 EH/s while daily hash rate concurrently tagged 112.9 EH/s. Blockchain.com estimates Bitcoin’s hash rate to have fallen from 151.1 EH/s on Oct. 24 to 116.3 EH/s the following day.

The province of Sichuan is one of the world’s largest hubs for mining activity. Miners flock there to take advantage of cheap hydro-electricity during the rainy season and then just as quickly leave. In 2018, it was estimated that 80% of Chinese miners migrate to Sichuan for rainy season from other parts of the country. CoinShares data published during December 2019 estimated Sichuan represents 54% of global mining activity. Heller also shared data estimating the next Bitcoin mining difficulty adjustment at the end of this week will see a reduction of between 7.4% and 8.8%. If accurate, the event would comprise 2020’s second-largest negative adjustment after the near 16% drop that followed the ‘Black Thursday’ crash in March.

BTC hash rate slumps amid seasonal miner migration in China, CoinTelegraph, oct 27