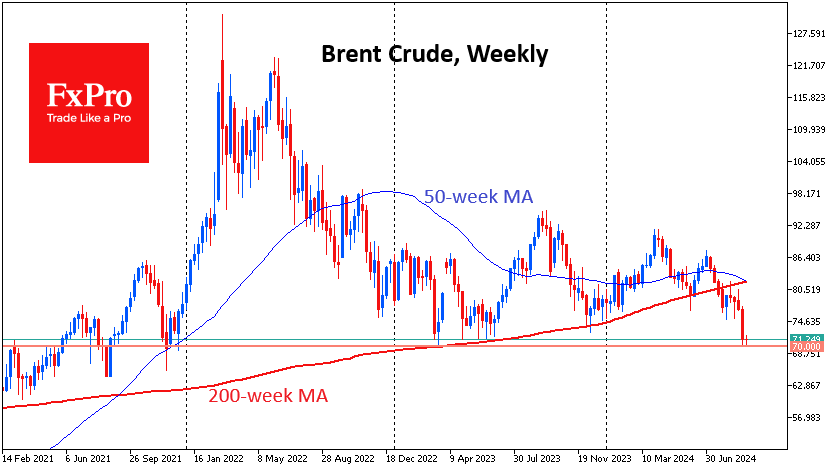

Oil pressure shows no sign of easing, with the price of a barrel of Brent touching lows of $70.50 last Friday and on Monday. The oil price has approached the psychologically important level, as it has traded consistently below $70 for more than three years.

Oil has reversed in June or July more than once in modern history, with the most notable reversals in 2008 and 2014 and the most recent in 2022. The current reversal has a chance of making history, too, if a break of the $70 support level triggers a massive liquidation of long positions.

The oil charts don’t show major pivot points until the $40/bbl level, so a test of $70 this week is extreme.

We can see that OPEC+ is trying not to miss this moment by once again attempting to support the spot price by postponing production increases last week. On the other hand, the oil market is now focused on the negative, selling oil on both news of a weakening economy and a stronger dollar.

The FxPro Analyst Team