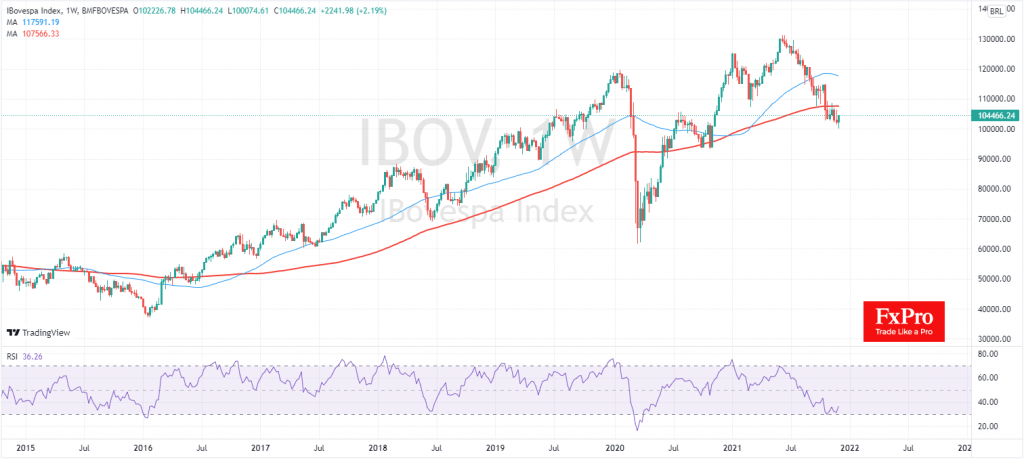

Brazilian market index Bovespa earlier this week came close to the psychologically crucial round level 100,000, having lost around 23% from its peak six months ago.

Despite this backdrop, the Brazilian market looks too depressed and is already showing some signs of recovery. Wednesday and Thursday’s intraday dips met increasing demand with a noticeable 3.7% gain on Thursday. In addition, the Brazilian index outperforming its EM peers in recent days.

The technical picture supports the idea of a close or even already occurred reversal to the upside. The RSI on the weekly charts has returned from the oversold territory – a signal of a potential rebound or reversal to growth. The divergence between the RSI and the index confirms the bullish sentiment, reflecting the reduced pressure on the Brazilian stocks.

The positive dynamics of foreign indices are also on the buyers’ side. Chinese indices have stopped falling since the beginning of the month, bouncing back from multi-month lows. US benchmarks gained support on Thursday, surfacing after briefly dipping below critical levels. Brazilian and many other markets look very attractive for downside buying without a principal reversal in US equities.

The FxPro Analyst Team