The impact of British politics is once again dominating UK markets. Numerous cabinet resignations and the demand for Boris Johnson to step down have proved to be a driving force for GBP currency pairs and the British stock market.

Recent reports suggest that Johnson is willing to step down as leader of the Conservative Party but remain Prime Minister until the results of the party election in the autumn.

Markets have taken the latest reports positively in hopes as it will reduce the degree of uncertainty and hope that the new cabinet will focus on dealing with economic hardship rather than the prime minister.

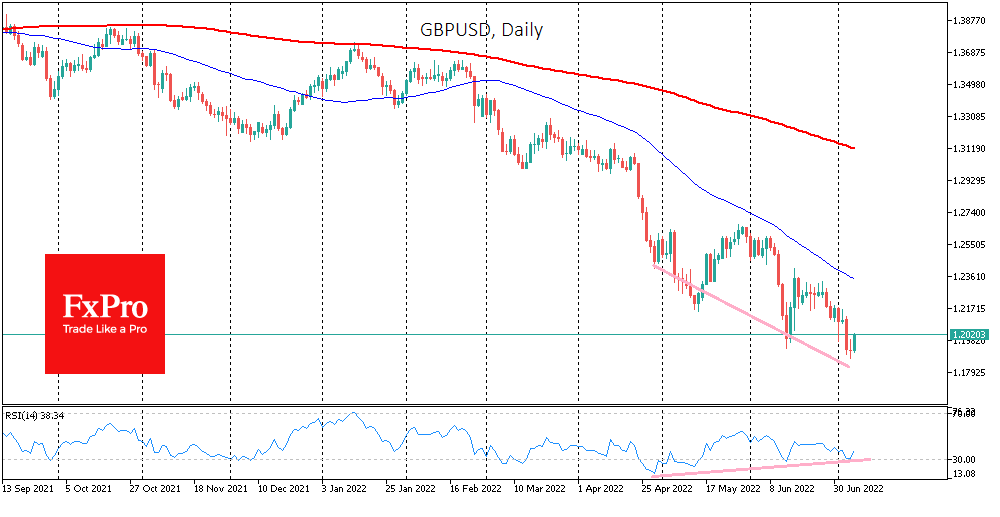

As a result, GBPUSD has added to 1.1980, 100 pips above the lows on Wednesday at the end of the day.

It is unlikely that the change of the UK leader will fundamentally change the economic outlook, as so much now depends on external factors and the Bank of England’s policies.

Nevertheless, a “relief rally” in British assets is likely. This could be especially true for the British pound.

The GBPUSD daily charts show an oversold and bullish divergence with the RSI. Such a disposition suggests support among buyers closely monitoring the technical picture, of which quite a few are on the currency market.

Команда аналитиков FxPro