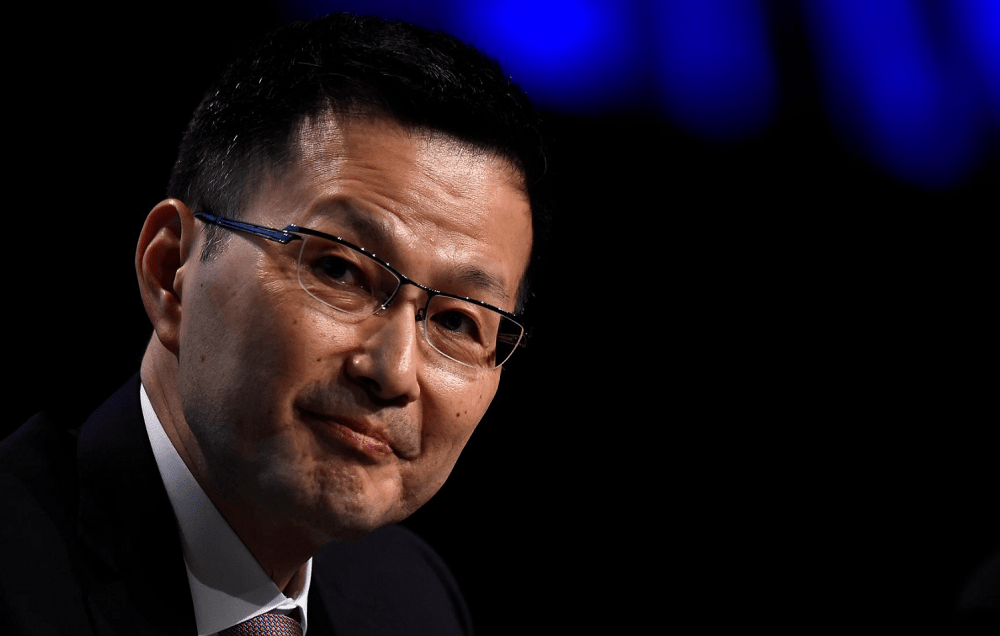

The Bank of Japan must be ready to cut interest rates further and keep exploring ways to battle economic shocks, Deputy Governor Masazumi Wakatabe said, signalling its resolve to keep or ramp up support for an economy hit by the COVID-19 pandemic. Wakatabe said the BOJ’s policy review in March won’t lead to a withdrawal of monetary stimulus, but will focus on making its tools “sustainable, effective and nimble”.

The key would be to ensure the central bank has sufficient ammunition to combat any future shock to the economy, such as one triggered by the coronavirus pandemic, he added. “The BOJ must guide policy in a way that ensures real interest rates don’t spike abruptly,” Wakatabe told reporters after an online meeting with business leaders on Wednesday. “We must also maintain our commitment to achieve 2% inflation. Based on the commitment, we’ll be ready to lower nominal rates as needed,” he said.

Wakatabe declined to comment on whether the March review will look at ways to address the side effects of negative rates, so that it can push rates deeper into minus territory. Some analysts speculate the BOJ could expand its loan programmes to channel more money to financial institutions and firms that boost investment in green and digital technology.

BOJ must be ready to cut rates, explore tools to battle shocks, says deputy governor, Reuters, Feb 3