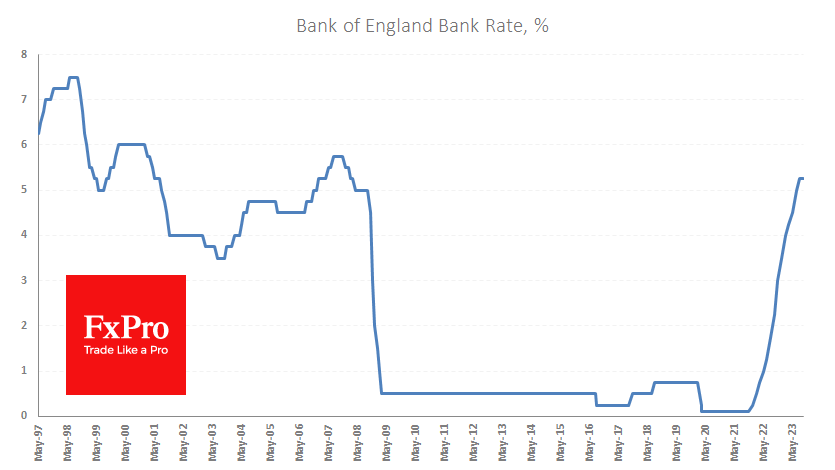

The Bank of England has left its key interest rate unchanged at 5.25%. The likelihood of such an outcome was actively priced into Pound quotes following yesterday’s UK inflation report.

The accompanying commentary noted the Bank of England’s worsening outlook for GDP growth and signs of deterioration in the labour market. In addition, the central bank expects inflation to slow significantly in the near term.

This is a much softer stance than we had expected, given the return of higher energy prices, the turnaround in producer prices and the still very high level of consumer inflation.

Today’s decision has raised expectations that the Bank of England has reached an interest rate ceiling. A similar scenario is now the main one for the Fed, the ECB and the SNB.

The Bank of England’s focus on the economy rather than inflation briefly sent GBPUSD to 1.2250, its lowest level since March, bringing the pair’s overall decline from its July peak to 6.8%.

The British Pound fell below its 200-day moving average this week, returning to a bearish trend. On the other hand, the pair has accumulated a short-term oversold condition over the past two months, which increases the chances of a corrective bounce in the coming days, paving the way for further declines.

Except for the US, September seems to be a turning point for the G7’s central banks. The Fed yesterday signalled the greatest willingness to raise rates soon and to keep them on hold for an extended period. In contrast, many opted to signal that they are comfortable with the current level of interest rates. This divergence is fuelling the strengthening of the US currency, albeit at a high cost to the US government, whose nominal debt servicing costs have risen to unprecedented levels.

The FxPro Analyst Team