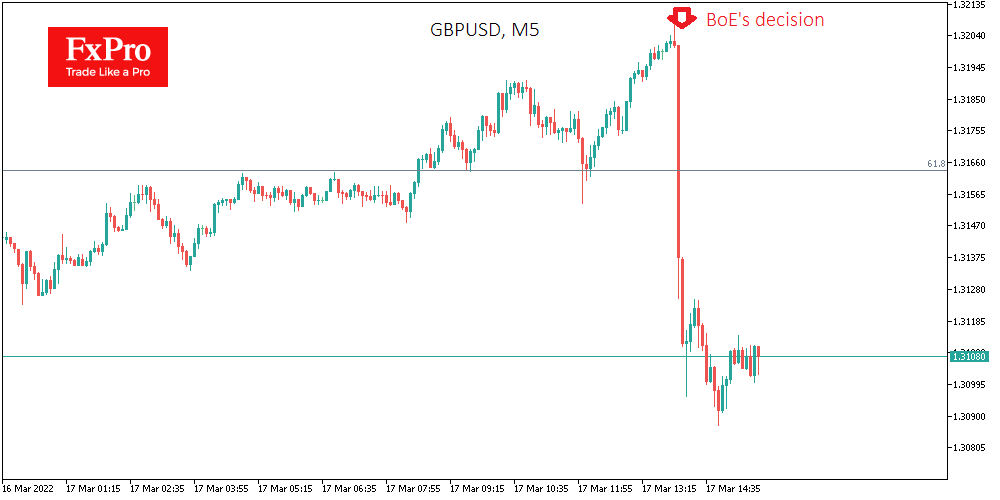

The Bank of England raised the rate by 25 points to 0.75%. Such a move was, on average, predicted by market analysts. However, reports that one member of the Bank of England voted to maintain the rate was seen as less confidence in further hikes.

The Bank’s deputy governor Jon Cunliffe voted against a rate hike, noting the risks of falling demand due to a jump in commodity prices. This vote against caused GBPUSD to immediately fall more than 120 pips, briefly sending GBPUSD below 1.3090. However, the weakening pound supported the stock market, bringing the FTSE100 back to its opening levels, in contrast to the declines in most foreign indices.

Earlier, the FOMC made less harsh comments on interest rates than the market expected to see. The Bank of England, like the Fed yesterday, raised its inflation forecasts considerably and pushed back the forecast peak further, given the latest price hike.

Like after the 2008 financial crisis, the Fed and the Bank of England are leaving the economy at the forefront to tighten policy. The currency market was ready to see more determination in raising rates. The current measured approach forms a more favourable environment for financial markets than expected at the start of March.

The FxPro Analyst Team