There was an important signal today that monetary authorities in North America are ready to ease the pace of policy tightening faster than the market expects.

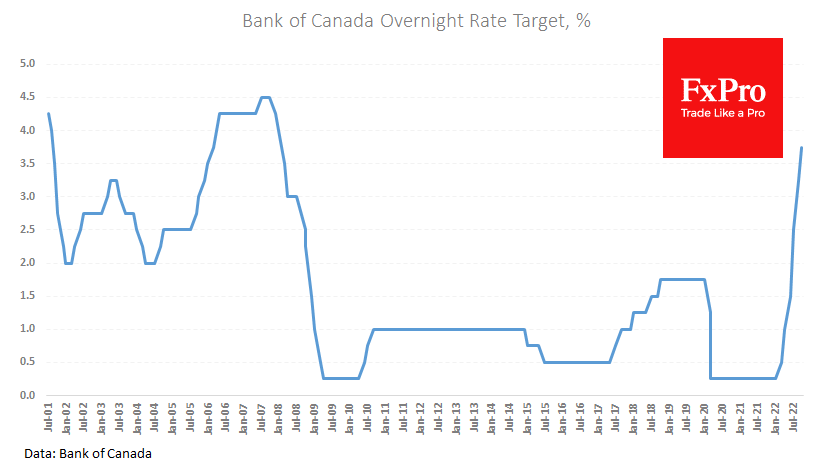

The Bank of Canada raised the rate by 50 points to 3.75%, although analysts, on average, predicted a repeat of September’s move with a 75-point hike. While the Bank of Canada’s commentary on the decision pointed to the need for further rate hikes, there is no getting around the fact that the central bank is now more concerned with fine-tuning its policy rather than chasing fleeing prices.

The Bank has noted a slowdown in consumer price growth from 8.1% to 6.9% over the last three months. The situation in the USA is not much different, with inflationary pressures also declining. However, the fundamental difference is that the expensive dollar raises inflation elsewhere and reduces it in the USA. Hence, a more fine-tuning phase becomes more relevant for the Fed, too.

The USDCAD reaction is also very indicative. From the highs near 1.3650, where the robots pushed the pair in the first moments after the release, it has rolled back 0.8% to 1.3540 in just over an hour. As a reminder, just three months ago, raising the rate less than the Fed was practically dooming the currency to fall. However, today the USDCAD is retesting October lows.

The FxPro Analyst Team