Oil is losing about 2% on Monday morning, down to $63 for Brent and $59.60 for WTI on reports that Egypt managed to unblock the Suez Canal from the container ship Ever Given. Sector analysts are trying to determine how long it will take to fully clear the resulting jam of hundreds of vessels on both sides of the canal.

Economically, this incident does not affect the global balance of oil supply and demand, whose volumes have not changed. In a matter of days or weeks, the supply situation will get back on track.

Simultaneously, blocking the channel could have a psychological effect on the markets, which is just as important. Commodity and stock markets have restrictions on price movements – trading is suspended, which can often disrupt unidirectional market movements.

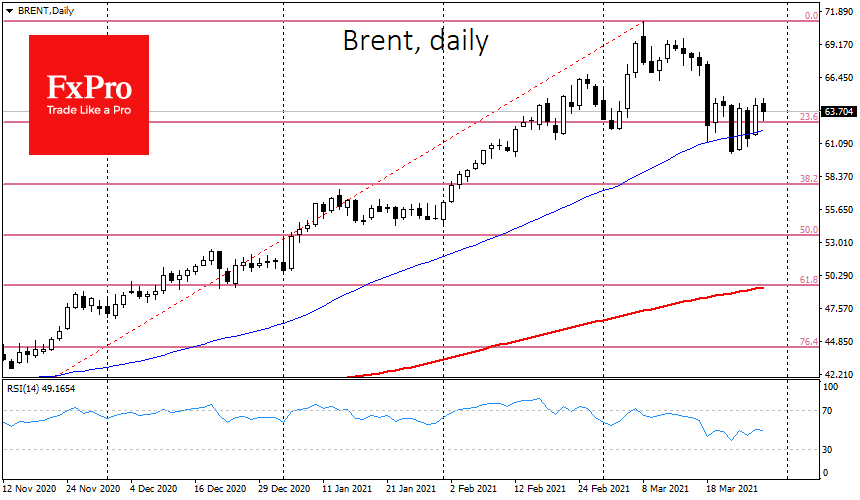

The day before Ever Given closed the Suez Canal, Brent and WTI collapsed 6%, falling under the 50-day moving averages, and the dip from the peak in early March was over $10 or 15%.

There are a fair number of short-term speculators in the oil market who have tried to play the upside due to the uncertain short-term outlook. But perhaps most importantly, these developments have stopped a self-sustaining and ever-growing downturn in a recently overheated market.

Oil has now nailed itself to its 50-day moving average in anticipation of the OPEC+ advisory council meeting on the first of April, where the fate of May quotas will be discussed.

Elsewhere, US data noted a new rise in the number of oil drilling rigs last week to the highest since May. Another report earlier in the week showed that production had returned to 11m b/d, where it had been with few exceptions since June last year. Increasing drilling activity promises a rise in output in the coming months. However, even now, it remains at historically high levels. America only produced more than the current levels from September 2018 to May 2020.

The speed at which oil has fallen over the past three weeks is likely to strengthen Saudi Arabia’s position in favour of extending tight production quotas. The Saudis are clearly on the side of the market bulls, despite hopes of a consumption recovery. Fluctuations in recent days have marked short-term resistance at $65 for Brent and $61 for WTI. Overcoming these values would convince markets that the Suez pause proved to be a necessary reset for oil, which is now attractive to buyers after a pullback from peaks in early March.

The FxPro Analyst Team