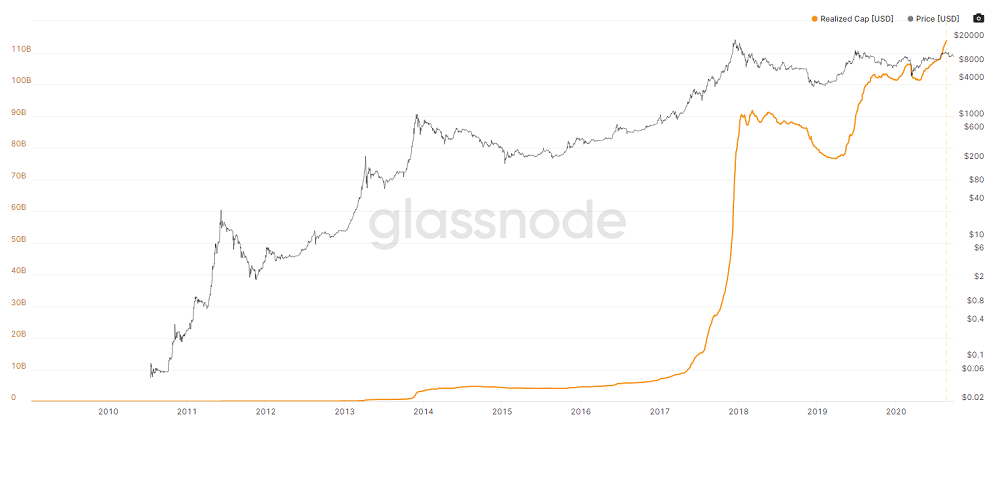

Crypto market data aggregator Glassnode has published data indicating that Bitcoin’s (BTC) realized capitalization has increased by more than 50% since tagging its all-time high of $20,000 at the end of 2017. The realized capitalization metric measures the value of each BTC when it was last moved on-chain, which enables analysts to estimate the aggregate cost-basis of market participants.

However, coins on centralized exchanges are absent from the metric, indicating the data is probably more accurate in terms of the cost-basis of long-term investors rather than intra-day speculators. Bitcoin’s realized cap currently sits at $115 billion — $43 billion more than at the all-time high in 2017. Bitcoin’s current $190 billion market cap suggests that the BTC hodlers are presently enjoying an aggregate profit of 65%.

Coinmetrics’ chart shows that realized capitalization continued to grow higher in the early months of 2018, pushing to test $90 billion three times between January and May despite prices having crashed back below $10,000. While pre-halving speculation saw Bitcoin’s realized cap grow by 6% in Q2 2020, the violent ‘Black Thursday’ crash quickly reversed 2020’s gains. Since May, the BTC’s realized capitalization has steadily trended upwards.

According to crypto data researchers IntoTheBlock, more than 72% of crypto addresses are currently profitable, with the largest sum of investments having been made in the $1,040 to $5,285, and $8,450 to $9,560, price ranges.

Unlike Bitcoin, Ethereum’s (ETH) realized capitalization of $26.3 billion is still a long way from reclaiming its past highs — currently sitting 25% lower than its 2018 record of $35 billion.

Bitcoin’s realized cap is now $43 billion above the 2017 all-time high, CoinTelegraph, Sep 24