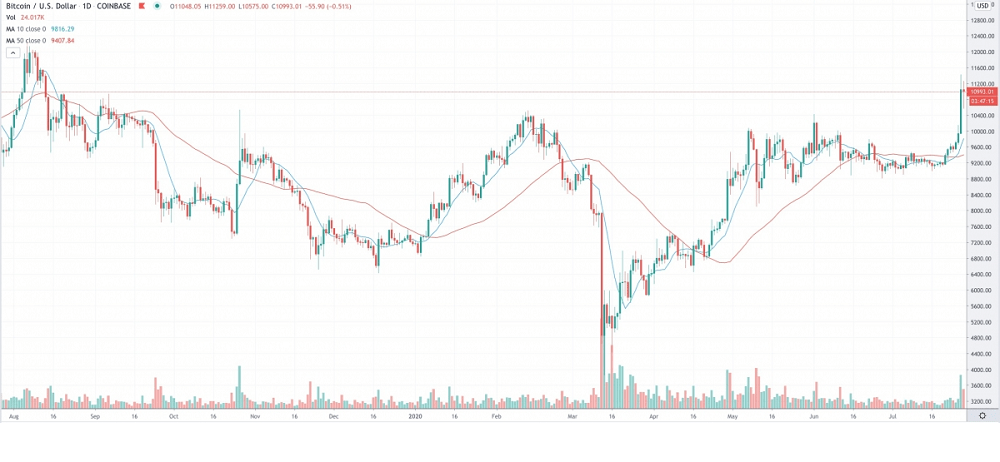

Bitcoin’s price is at its 11-month high as volatility bounces back up. Meanwhile, ether’s dominance has spiked on continued growth in decentralized finance (DeFi). The price of bitcoin hit another 2020 high Tuesday, reaching $11,422 on spot exchanges like Coinbase. The last time the price of the world’s oldest cryptocurrency hit that level on Coinbase was Aug. 12, 2019.

The Fear and Greed Index is in the ‘extreme greed’ zone, moving towards the overbought level. “Historical bitcoin volatility has bounced from its lowest point since March 2019,” said James Li, research analyst for CryptoCompare. “The question is whether this is just a temporary bounce or are we heading back to a historical, more volatile BTC market,” he added. The second-largest cryptocurrency by market capitalization, ether (ETH), was down Tuesday, trading around $318 after slipping 1.5% in 24 hours as of 20:00 UTC (4:00 p.m. ET).

The dominance of ether in the cryptocurrency market crossed 12% Monday, its highest point in 2020, according to data calculated by real-time charting firm TradingView. Dominance, or the market cap as a percentage of the entire cryptosphere, is a measure traders use to quickly get a sense of a cryptocurrency’s importance relative to the broader digital currency market. Although ether’s dominance has dipped below 12% Tuesday, it’s still higher than it has been all year; the last time ether hit 12% dominance was back in May 2019.

“DeFi users can access that market using stablecoins. But clearly the main core asset fueling the DeFi run is still ether, hence its recent dominance,” said Jean-Marc Bonnefous, managing partner for Tellurian Capital, which has been investing in crypto projects since 2014.“The recent development and ramping up of new and better DeFi applications such as Compound, Aave and Balancer is clearly generating more traction for Ethereum,” he added.

Market Wrap: Bitcoin’s Price and Ether’s Dominance Sit at 2020 Highs, CoinDesk, Jul 29