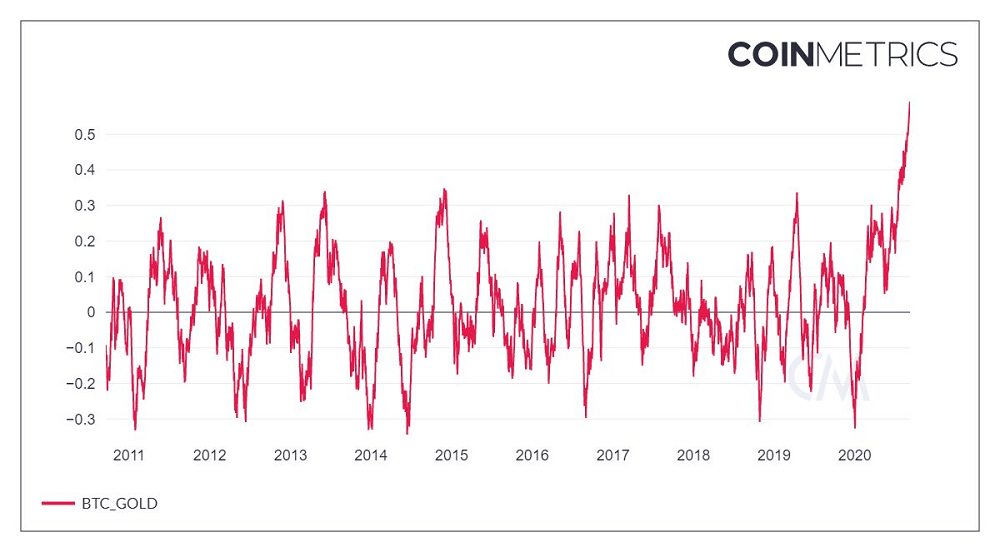

The 60-day correlation between the two assets is hovering at record highs above 0.5, according to Coin Metrics data. The positive correlation has strengthened sharply since the beginning of July, as the U.S. dollar started taking a beating against other major currencies. The sell-off in the greenback, the global reserve currency, is seen as boding well for scarce assets like bitcoin and gold.

The strengthening of the positive correlation appears to validate the popular narrative that bitcoin is a store of value and a haven asset. Some investors believe it is sound money, like gold. As such, the cryptocurrency’s sensitivity to movements in risk assets, mainly equities, could lessen. Bitcoin defended the $10,000 support for the fifth straight day on Monday, despite losses on Wall Street.

The repeated defense of the critical support, coupled with several bullish developments in on-chain metrics, suggests scope for a recovery rally. Bitcoin’s hashrate, or computing power, has risen to fresh record highs near 150 exahashes per second, according to Glassnode. That suggests miners remain unfazed by bitcoin’s recent decline from $12,400 to $10,000. Further, the percentage of bitcoin unmoved in over three years has hit a two-year high of 30.91%, according to data source Glassnode.

Bitcoin’s Correlation With Gold Hits Record High, CoinDesk, Sep 10