Market picture

Bitcoin has lost 1.2% in the last 24 hours, trading at $20.1K. The plunge below a meaningful round level late Wednesday afternoon did not last long. Ethereum pulled down 0.3% to $1610 while the crypto community awaits the market’s reaction to The Merge (move to PoS algorithm). We can describe sentiment across the crypto market as a cautious wait-and-see.

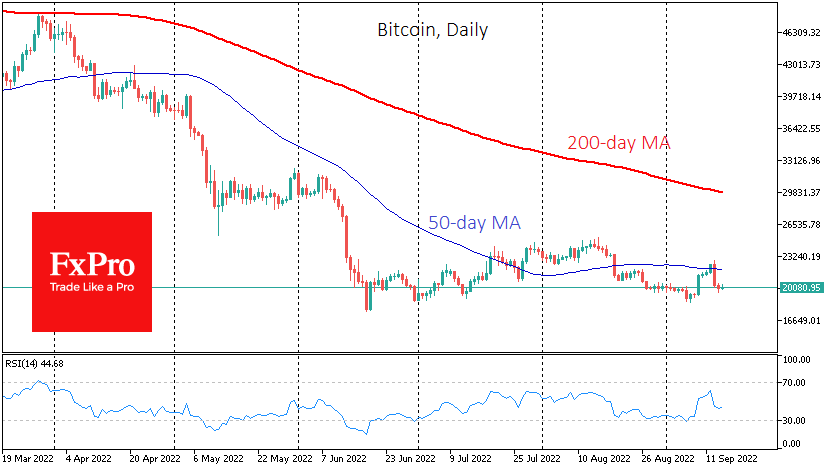

Short-term Bitcoin momentum indicates that sellers wanted to swing the market yesterday and snap stop orders at the end of the day, taking advantage of a period of reduced liquidity on Wednesday. As we see, it failed, and BTCUSD returned precisely to where it started its local decline. However, the balance of power is now on the bears’ side, as the global risk demand is suppressed, and critical technical levels (50- and 200-day MA, 200-week MA) are above the price.

News background

Major US companies Charles Schwab, Citadel and Fidelity have announced the launch of digital asset exchange EDX Markets (EDXM), which will be available to retail and institutional investors.

Another recalculation resulted in a 3.45% increase in bitcoin mining complexity to 32.05 trillion hashes, the highest in the network’s history.

Network service provider Cloudflare announced that its gateways support the upcoming transition of the Ethereum network to the Proof-of-Stake (PoS) consensus algorithm on September 15.

Bloomberg Intelligence expert Mike McGlone believes the crypto market will begin a bullish trend after The Merge update. In his opinion, ETH’s move to PoS will have a revolutionary impact on cryptocurrencies and the entire financial system.

Changpeng Zhao, chief executive of cryptocurrency exchange Binance, said the EU’s crypto-asset regulation principles could become the global standard for the entire industry.

The FxPro Analyst Team