They call it “max pain” in the bitcoin options market: How to make one’s trading counterparty suffer the most. Although the largest cryptocurrency was changing hands Wednesday around $56,500, traders were handicapping the odds of a plunge to about $44,000 by Friday, when a record $6 billion of options contracts is set to expire.

A drop to that price level would inflict “max pain” on buyers of options contracts, and it might be the most profitable price point for options sellers. It’s a remote risk, but not one to be discounted. The max pain theory states that the market will gravitate toward the pain point while heading into the expiry. That’s because sellers – typically institutions or sophisticated traders with ample capital supply – often try to push the price toward the max pain point by buying or selling the asset on spot or futures markets.

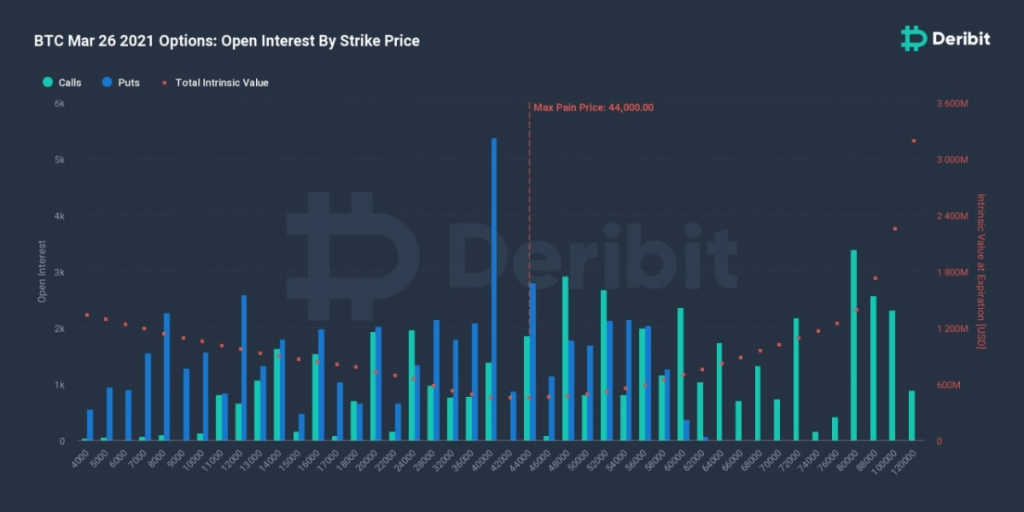

The bullish spin is that if bitcoin makes it through Friday without a major correction, a major overhang will be lifted. “Max pain for the March 26 expiry is currently $44,000 on Deribit,” Luuk Strijers, CCO of Deribit, the world’s largest crypto options exchange by trading volumes and open positions, told CoinDesk. “That does not mean the market will move to $44,000 by the end of this week, but it does imply that after Friday this potential downward pressure no longer exists.”

Max pain is calculated by adding the outstanding put and call dollar value of each in-the-money (ITM) strike price. An ITM call is one where the strike price is below the spot market price, while a put is considered ITM when the spot market price is below the put option’s strike price. A potential unwinding of trades as Friday’s expiry approaches may inject some volatility into the market, according to Pankaj Balani, co-founder and CEO of Delta Exchange.

Bitcoin Traders Brace for Record $6B in Options to Expire Friday, CoinDesk, Mar 25