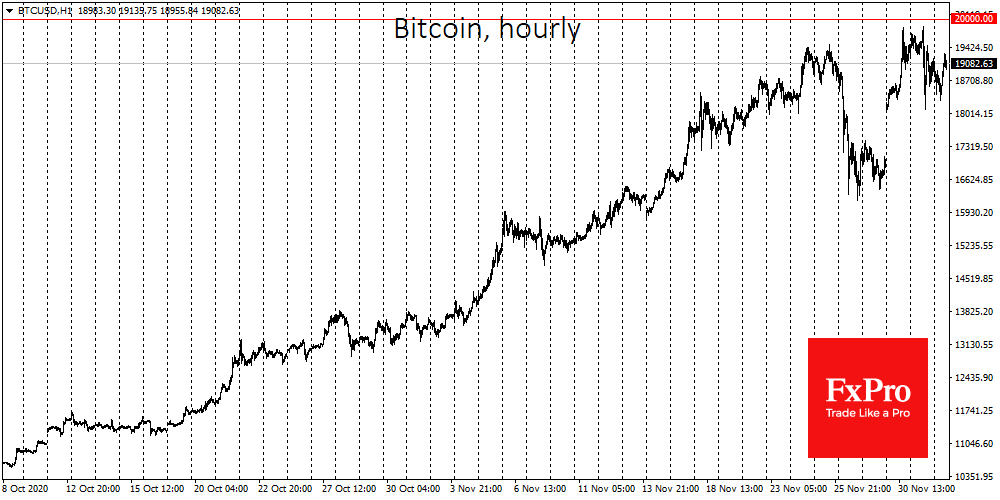

Bitcoin has unsuccessfully tried to reach the long-awaited psychological level of $20K several times. All attempts so far have ended with profit-taking and correction. The main question that now concerns all participants of the crypto market – is the current situation a reflection of the strong resistance or consolidation before a new spike?

A large-scale correction can form an impulse for continued growth by attracting buyers looking for discounts. Therefore, some investors do not pay attention to such turbulence. At the head of the current rally are large institutions, funds, and even the world’s largest payment system PayPal, which is integrating top cryptocurrencies into its service.

The next most important question, even for crypto enthusiasts: what is the maximum for Bitcoin in the case that the coin manages to overcome the $20K? Almost no one doubts that Bitcoin will manage to overcome this level, and on the FOMO wave, it is quite probable that the coin will soon reach $23-$25K and its growth potential will exceed $35K in the future. Of course, such impressive growth will be alternated by profit-taking investors who waited three years for Bitcoin’s return to the levels of the previous mania.

Nevertheless, even in this case, long-term investors are unlikely to sell the asset, as the size of this market is relatively small compared to the traditional one, which now has a lot of money but few directions for investment. Even the current levels of Bitcoin, which are very high by historical standards, are not an obstacle for large investors to absorb almost all the coins that appear on the market. Such a process naturally creates a deficit in the market and leads to Bitcoin appreciation. By the end of 2021, we can witness growth potentially up to $36-$40K.

In 2017, large capital didn’t see the huge potential of Bitcoin and watched global retail FOMO push the value to a historic high without any serious investment infrastructure. Now everything has changed: the rallies are created by institutions, and retail investors have just begun to move towards Bitcoin. The big difference is that major investors were able to collapse the market in 2017 but retail investors are unlikely to be able to do the same now by taking a profit. Will they even want to do it against the backdrop of a rush for growth?

The current bullish pattern will come down to making most market participants believe in the imminent growth of Bitcoin. This will be quite easy to do, given the challenges the global economy faces and how quickly entire industries that enjoyed growth previously can depreciate.

The FxPro Analyst Team