Recently, BTC has been leaving a string of broken records in its wake after passing the psychologically key $20,000 mark for the first time on Dec. 16. In the last several days BTC seems to found yet another gear, breaking through $25,000 Friday night for the first time, and going through $26,000 Saturday afternoon like a hot poker through one-ply tissue.

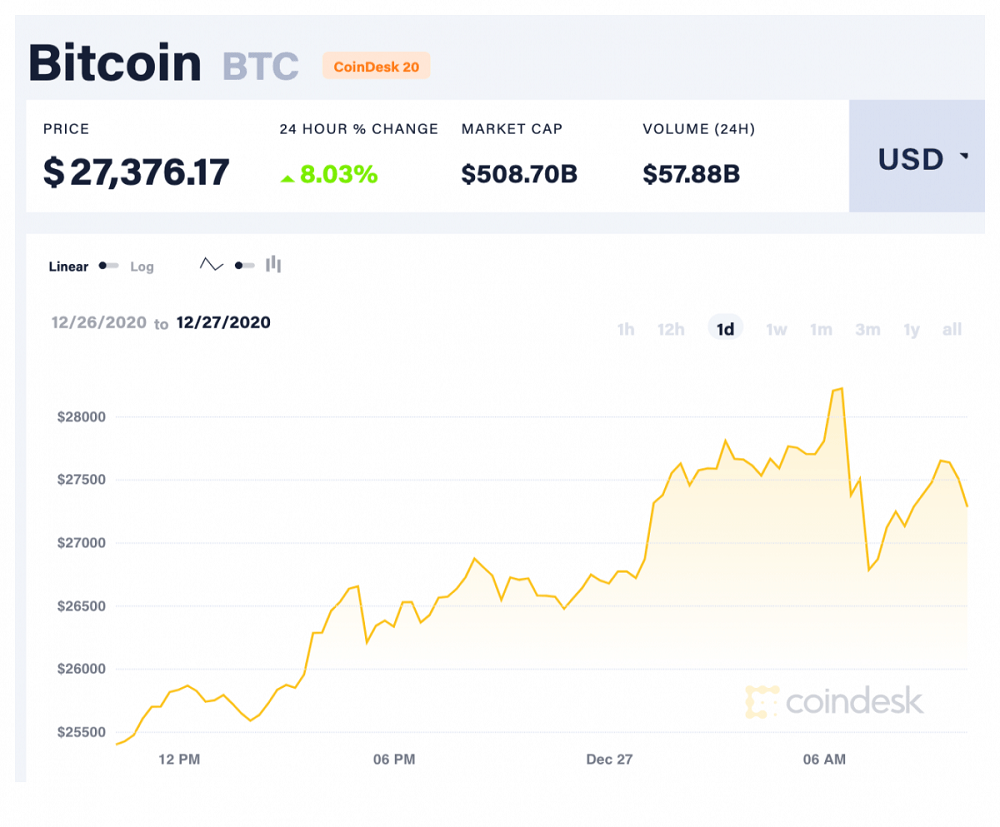

Roughly half a day later, BTC surged past $27,000 early Sunday morning, before racing past $28,000 just before dawn, before settling down to $27,604.67 at this writing, up 9.63% in the last 24 hours. Year-to-date, BTC is up more than 275%. In the last 48 hours, it’s risen 14%. With a market value of $512.34 billion, BTC is now more valuable than all but seven publicly traded companies, sitting between Alibaba at $545.4 billion and Tencent Holdings at $509.7 billion, according to Statista data.

Institutional investors are perceived to be driving this record-setting run. Among them: Anthony Scaramucci’s Skybridge Capital ($25 million in December); MassMutual ($100 million in December); and Guggenheim (up to 10% of its $5 billion macro fund).

With the end of the year looming, some fund managers may also be buying BTC so they can brag next year about being smart enough to get in in 2020 while neglecting to say at which price they had done so.

In addition, the U.S. Federal Reserve, along with other central banks, has been printing money with abandon trying to stave off the worst economic effects of the pandemic, while U.S. President Donald Trump has been pushing Congress to pass an even bigger relief package to allow for larger stimulus checks. These actions are viewed by many as potential catalysts for inflation and bad for the U.S. dollar, both of which could be positive for BTC.

While the tremendous rise in BTC might make it easy to think we’re going to see $30,000 before the end of the year, it’s good to keep in mind that this surge is taking place over a holiday weekend on thin volume. Monday could well bring a different narrative.

Bitcoin Tops $28K for 1st Time, Hours After Crossing $27K; Market Cap Now Exceeds $500B, CoinDesk, Dec 28