Between Sep. 9 and 16, the price of Bitcoin (BTC) rose by over 11%. Similarly, in the same period, Tesla stock (TSLA) surged from $330.21 to $449.76, by 36.2%. Tesla stock and the Bitcoin price have seen an uncanny correlation in recent weeks. The correlation might come from the similarities between BTC price movements and the S&P 500. It also might be related to the fact that millennial traders actively trade both BTC and TSLA.

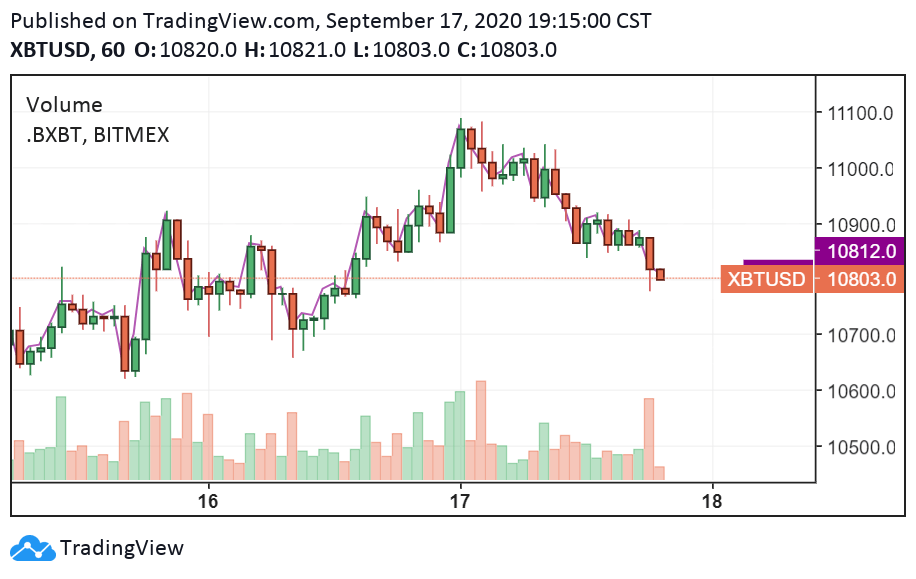

The day the price of Bitcoin spiked above $11,000 across major cryptocurrency exchanges, Tesla stock price neared its record high. TSLA slumped since early September after the Financial Times unmasked SoftBank as the Nasdaq whale. Following the report, a market-wide sell-off continued with the Nasdaq falling by 10% in six days. But after the initial drop, the U.S. stock market began to recover and the Tesla stock price rebounded. Coincidentally, Bitcoin rose from $10,300 to $11,100 at the same time.

Another asset that has seen some correlation with the price of Bitcoin is avocados. The spot price of Mexico City Hass Avocado from Michoacan has moved similar to BTC since June 2018. One similarity between Bitcoin, avocados and Tesla is that the three are liked by retail traders and millennials, in particular.

On Jul. 14, for instance, Bloomberg reported that 10,000 day-traders on Robinhood bought Tesla shares in a single hour at the day’s peak. Major market data providers are also noticing some similarities between Tesla and Bitcoin. As Cointelegraph reported, TradingView said Tesla and Bitcoin were the most viewed assets in July, as the demand for day trading soared.

The demand for avocados rose in recent months as well alongside Bitcoin and Tesla, according to avocado suppliers. Axarfruit’s manager Álvaro Martínez said:

Where does Bitcoin go from here?

In the short term, traders expect either another test of $10,110 or a breakdown to $10,200. Michael van de Poppe, a full-time trader at the Amsterdam Stock Exchange, said BTC is at a crucial resistance. He said: “The levels I’m watching on $BTC are structured here. The short term still trending upwards, but on a crucial resistance to break. If $10,750 fails to hold, $10,600 is next, and most likely the area around $10,200. If $10,750 holds, another test of $11,100 seems likely.”

Bitcoin, Tesla and avocados: millennial traders are saying ‘OK boomer’, CoinTelegraph, Sep 17