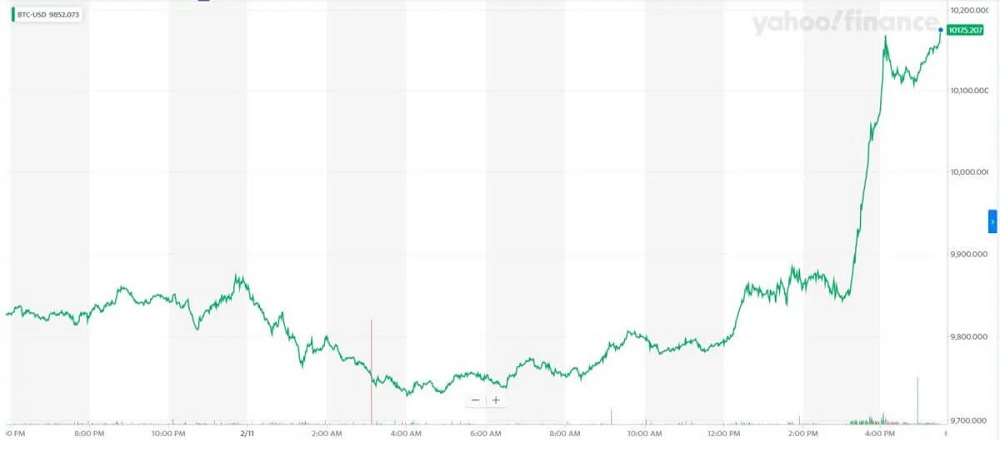

At around 15:00 UTC on Feb. 11, the price of BTC rose back above $10,000 from around $9,850 to $10,351 within an hour after succumbing to a small sell-off beneath the $10,000 level on Feb 10, CoinDesk BPI data shows. The peak figure represents BTC’s highest point in over five months and offers a shift in trend from bearish-to-bullish in the mid-term as it continues to print new highs in 2020.

Bitcoin

Cryptocurrency markets soared after Congressman Bill Foster raised concerns about the need to keep pace with China’s digital currency ambitions to which Powell responded that the Fed has a “lot of projects” underway. It is well documented that China has tremendous ambitions in the realm of digital currency. Congressman Foster’s concerns about Beijing’s ambitions centers on the risks posed to the U.S. dollar’s status as global reserve currency. Bitcoin investors took this as a positive development, as BTC/USD soared on Powell’s acknowledgment that the Fed would “keep the fire lit” regarding blockchain development.

Despite the impressive response from cryptocurrency markets, the Fed chair was still guarded about the implementation of a digital dollar due to privacy concerns: The idea of having a ledger where you record everyone’s payments isn’t particularly attractive in the U.S.; it’s not a problem in China. Despite this, Powell was clear that the theoretical implementation of Facebook’s Libra had been a game-changer, and that his institution now understands the importance of making “quick progress in this area.” It’s quite obvious why bitcoin would rally so aggressively in this instance, as the most powerful man in finance acknowledged the speed and scale in which digital currency could disrupt the dollar. This is a definite change of tone from the FOMC’s historical opinion on this issue.

The sudden surge in value may be attributed to three catalysts including increased institutional and retail demand for cryptocurrencies, BTC’s halving event and macro developments, with a focus on the uncertainty surrounding the coronavirus outbreak, analysts and traders said.

BTC’s halving event, an occurrence every four years where the bitcoin network undergoes a 50 percent reduction in its mining rewards, has been spurring bullish sentiment reflected in both the spot and derivatives markets. Data from Skew analytics demonstrates how institutional buying pressure continues to provide a solid base of support for the world’s largest crypto by market cap, reflected in a legitimate increase in derivatives volume and open interest.