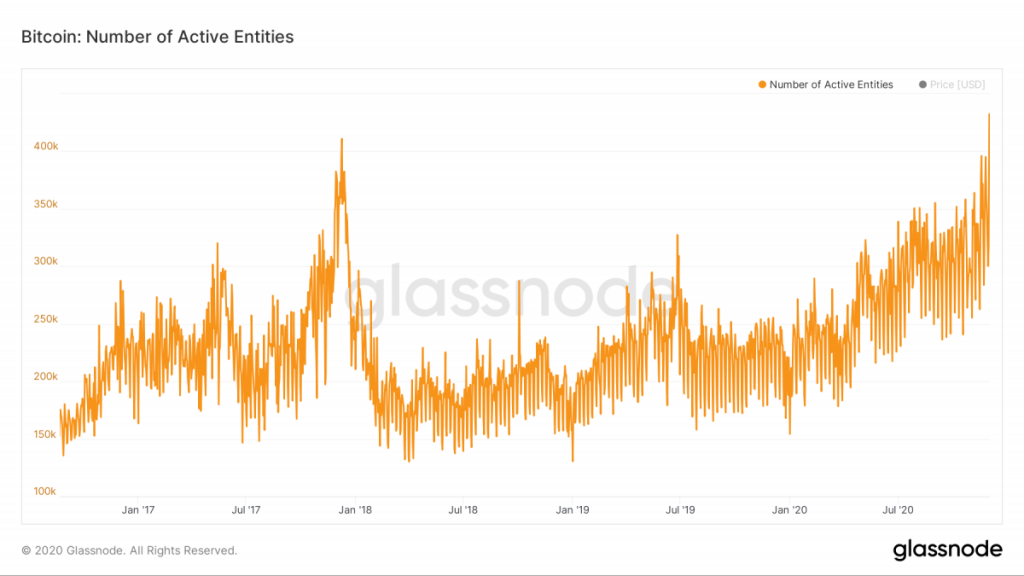

As bitcoin continues to set new price highs, its network is also seeing record-breaking user activity. As of Tuesday, there were 432,451 “active entities” – wallet clusters controlled by a single participant that sent or received funds in a 24-hour period. That’s an all-time high, according to data provided by blockchain analytics firm Glassnode. The previous peak of 410,972 was registered on Dec. 9, 2017.

“The number of active entities has been increasing steadily since the halving and signifies a large increase in network adoption by participants,” said Matthew Dibb, co-founder of Stack, a provider of cryptocurrency trackers and index funds.

Bitcoin underwent its third mining reward halving on May 11 of this year. Since then, the number of active entities has increased by 70% and bitcoin’s price has more than doubled to nearly $20,000.

The cryptocurrency printed a record high of $19,920,53 on Tuesday before falling back. Bitcoin was trading around $19,130 at time of writing, representing a 1.7% gain on the day.

While bitcoin’s price gains have been relatively sharp over the past eight weeks, the number of active entities has charted relatively steady growth. “While the metric has breached highs not seen since 2017, it has done so gradually without ‘bubble-like’ growth,” Dibb told CoinDesk. “We take comfort in this when correlating address clusters with forward-looking price action.”

Analysts consider increased activity as a bullish sign. “When there’s greater usage, there’s more demand for the cryptocurrency, and that drives the price up,” Philip Gradwell, chief economist at blockchain intelligence firm Chainalysis, previously told CoinDesk.

Bitcoin Sees Record Number of Active Users as Price Almost Hits $20K, CoinDesk, Dec 2