Bitcoin’s price reversed Wednesday’s losses on Thursday. Traders and analysts, however, have largely kept a short-term bearish view because some are attributing gains in bitcoin and other cryptocurrencies to GameStop’s stock drama.

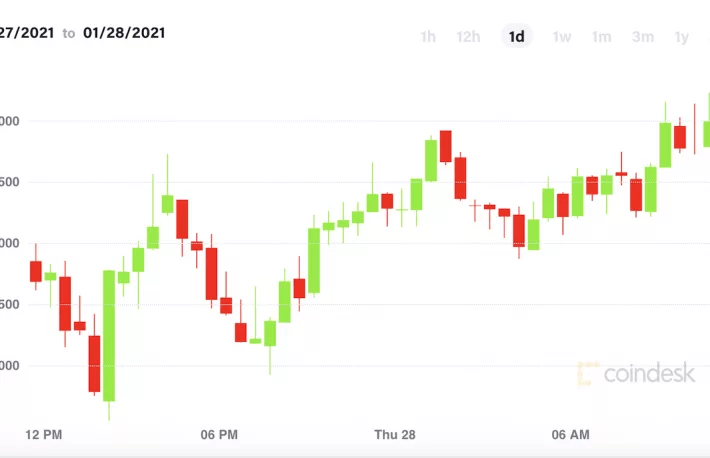

Bitcoin (BTC) trading around $32,607.78 as of 21:00 UTC (4 p.m. ET). Gaining 3.17% over the previous 24 hours. Bitcoin’s 24-hour range: $29,921.96-$32,934.56. BTC above its 10-hour and 50-hour averages on the hourly chart, a bullish signal for market technicians.

GameStop’s stock drama seems to be galvanizing not just stock markets but bitcoin and other cryptocurrencies, many of which reversed their losses of just a day ago, similar to what happened in the U.S. equities market. The most notable winner was dogecoin (DOGE), which hit a new all-time high earlier Thursday.

Few attribute bitcoin’s price gains Thursday to market fundamentals. That’s because the crypto community still looks to be distracted by the GameStop (NYSE: GME) situation. A group of Redditors on a board called WallStreetBets (WSB) sent the video game retailer’s shares skyrocketing in order to squeeze hedge funds that were betting the stock’s price would go down.

On the technical side, bitcoin is near short-term oversold levels, yet momentum is still on the downside, according to Katie Stockton, managing partner at Fairlead Strategies.

Retailer traders’ fear of missing out (FOMO) may be the big driver of both equity and crypto markets at the moment, but it isn’t clear if new institutional investors are buying more bitcoin, which could affect its price.

As CoinDesk reported previously, many institutions may be pausing bitcoin purchases until they have further clarification on how the new Biden Administration views bitcoin and other cryptocurrencies.

Market Wrap: Bitcoin Reverses Wednesday’s Losses, Ether Climbs, CoinDesk, Jan 29