Bitcoin (BTC) trading around $22,818 as of 21:00 UTC (4 p.m. ET). Gaining 9% over the previous 24 hours. Bitcoin’s 24-hour range: $20,756-$23,770. BTC below its 10-hour moving average but well above the 50-hour on the hourly chart, a bullish-to-sideways signal for market technicians.

The price of bitcoin continued its rise to all-time highs, going up to $23,770 as of press time in a highly bullish run that had lots of volume-fueled momentum.

The $23,800 level may be a spot of exhaustion for the world’s oldest cryptocurrency, according to Constantin Kogan, partner at financial firm Wave Financial. “There’s some strong selling resistance at $23,800. Let’s see if bitcoin can break it,” Kogan told CoinDesk.

Volumes on Thursday were higher than on Wednesday, with the eight major exchanges tracked by the CoinDesk 20 seeing over $3.5 billion in volume so far as of press time versus $2.9 billion the day previous.

“Breaking the $20,000 psychological barrier was a strong bullish signal allowing bitcoin to set a new record high,” said Elie Le Rest, partner at crypto quant trading firm ExoAlpha. However, Le Rest cautioned about crypto’s classic gyrations possibly affecting the market. “Volatility is very high and small pullbacks have been witnessed along the way.” Indeed, bitcoin’s 30-day volatility has been picking up and will be something to watch over the balance of December.

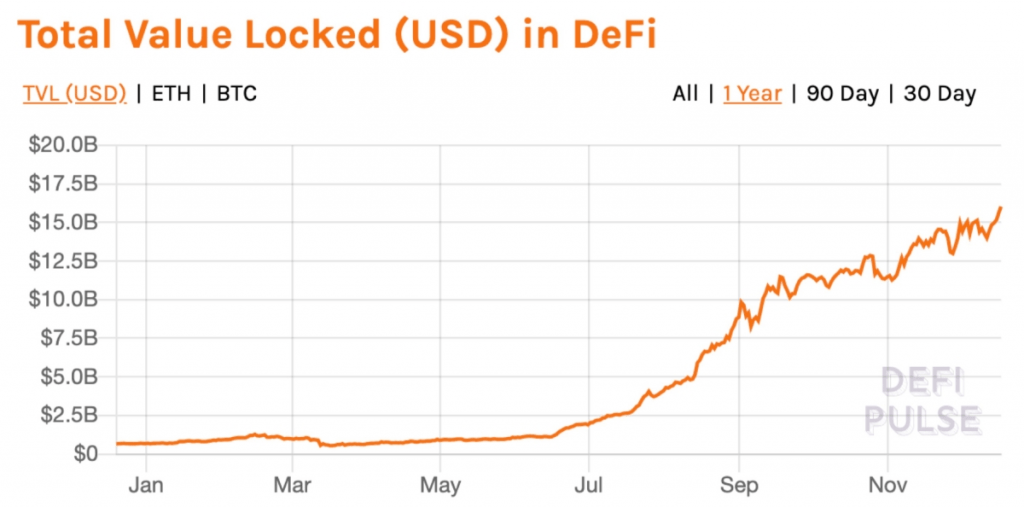

The amount of crypto “locked” in decentralized finance, or DeFi, is at $16 billion as of press time, increasing over 2,200% from the $690 million locked at the start of 2020.

Bitcoin Pushes Past $23.7K While Crypto Locked in DeFi at All-Time High, CoinDesk, Dec 18