How high can bitcoin’s price go? Analysts say the higher the price, the more investors will plow in. Meanwhile, increasing ether options volume on Deribit is likely making derivatives more expensive.

Bitcoin (BTC) trading around $18,987 as of 21:00 UTC (4 p.m. ET). Gaining 3.2% over the previous 24 hours. Bitcoin’s 24-hour range: $18,059-$19,392 BTC below its 10-day moving average but above 50-day, a sideways signal for market technicians.

Bitcoin’s price broke above $19,000 Tuesday, hitting as high as $19,392, according to CoinDesk 20 data. Its price lost some steam after but rebounded to $18,987 as of press time.

“We could test an all-time high today,” said Rupert Douglas, head of institutional sales for crypto broker Koine. “We have had such a strong run-up that I’d be looking to take profits.”

Bitcoin’s record price high was $19,738 back on Dec. 18, 2017, according to CoinDesk 20 historical bitcoin data.

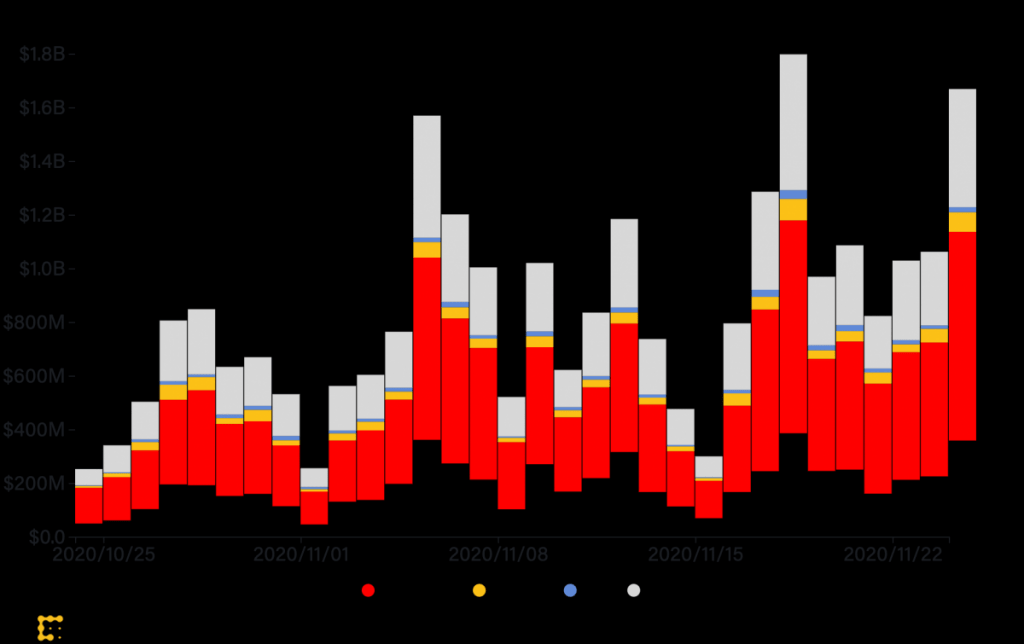

At over $1.6 billion as of press time, momentum in the form of USD/BTC volumes on five combined major exchanges is set for another banner day. Tuesday is shaping up to be the second highest in the past month as billion-dollar volume days for the five exchanges are becoming more common.

An optimistic economic environment has given both stocks and bitcoin “risk-on” properties as investment assets.

Analysts expect $20,000 per 1 BTC to arrive soon, which could produce some profit-induced selling but also more bullish buying, according to Rich Rosenblum, head of trading at crypto firm GSR.

Ether (ETH), the second-largest cryptocurrency by market capitalization, was up Tuesday, trading around $604 and climbing 1.6% in 24 hours as of 21:00 UTC (4:00 p.m. ET).

Market Wrap: Bitcoin Pushes Past $19.4K; Deribit Ether Options Volume Spikes, CoinDesk, Nov 25