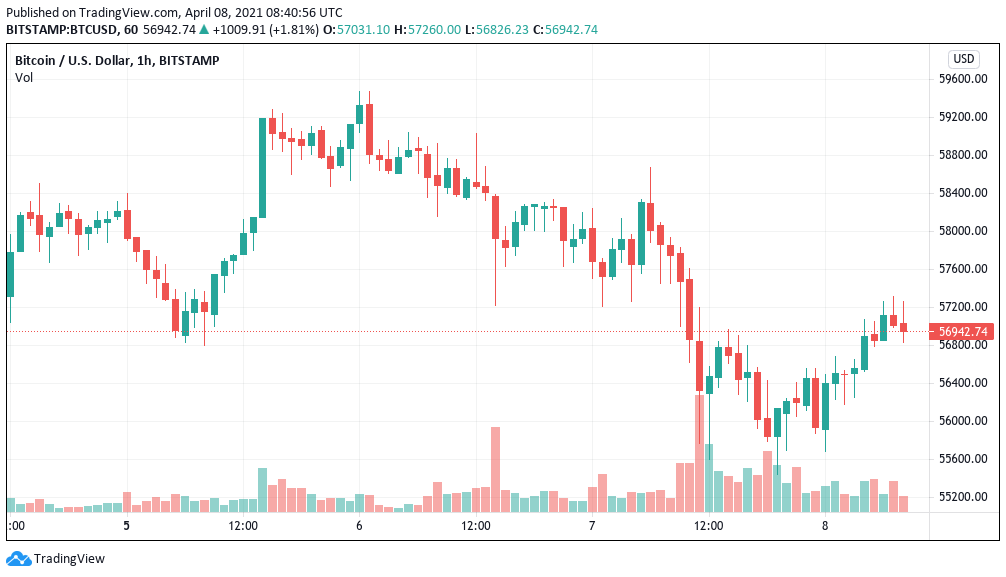

Bitcoin (BTC) barely recovered its losses on April 9 as fresh doubts emerged about the bull run continuing this month. After sliding 5% on Wednesday, BTC/USD saw only a modest rebound to circle $57,000 at the time of writing, Cointelegraph Markets Pro and TradingView showed. Following multiple failed attempts to crack resistance close to all-time highs, analysts were becoming wary of a further dip and a temporary halt to further price gains. Filbfilb, co-founder of trading suite Decentrader, described this week’s current floor of $56,760 as “not a convincing bottom.”

As reported on Wednesday, funding rates among trading platforms call for a shakeout of leveraged long positions from those overly bullish on a continuation. For Filbfilb, those rates remain “way too high,” he told subscribers of his Telegram trading channel. Popular Twitter trader Cantering Clark meanwhile pointed to Bitcoin’s 20-week moving average (MA) — a classic “line in the sand” for price performance — still lingering at around $40,000.

Despite institutional interest continuing in recent weeks, fuelled by major new adoption announcements from banks, signs of a slowdown were also beginning to show on the day. The Purpose Bitcoin ETF saw a slight reduction in its BTC holdings after consistent growth, with its assets under management dipping in tandem from highs of $976 million to $944 million.

Fellow institutional portal Grayscale’s Bitcoin Trust (GBTC) maintained its negative premium, meanwhile, a phenomenon which has put pay to further Bitcoin accumulation since February. But not everyone was wholly gloomy. For trader trader Crypto Ed, the ultimate market trajectory was clear. “Not in a rush to get in a position,” he told Twitter followers on Thursday. “54k first or up from here, both mean we’re starting a strong 3rd leg and plenty of upside waiting for us. BTC will break 60k and finally go much higher.”

Bitcoin price stalls as traders warn BTC could dip lower than $55K, Cointelegraph, Apr 8