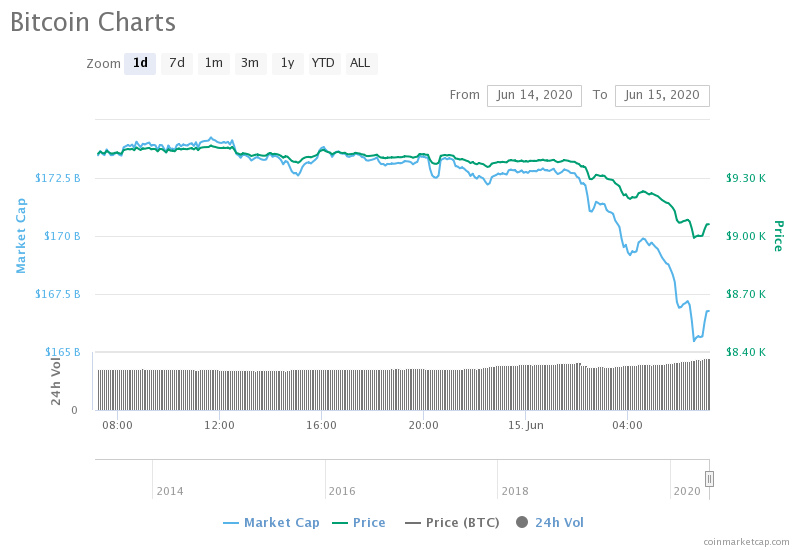

Bitcoin (BTC) dropped below $9,000 on June 15 as a new week produced fresh selling pressure across macro assets. Data from Cointelegraph Markets and CoinMarketCap showed BTC/USD entering the $8,000 range in Monday trading — for the first time since May 28.

The latest bearish move follows a difficult week for Bitcoin in which markets almost regained $10,000 before shedding $800 in a matter of hours on Thursday. After spending the weekend at around $9,400, support gave way once more as the outlook for the week on stock markets looked bleak. At press time, BTC/USD traded at around $9,000 amid an attempt to re-establish the level as support.

On Sunday, Dow Jones futures alone fell 900 points, with United States markets similarly uncertain prior to opening. As Cointelegraph reported, Bitcoin has become increasingly resilient to the impact from stocks gaining or losing dramatically, a process which has become known as “decoupling.” Nonetheless, hints of correlation remain, with Bitcoin now at its lowest in over two weeks.

Bitcoin Price Dips Below $9K Amid Heavy Stock Market Futures Losses, CoinTelegraph, Jun 15