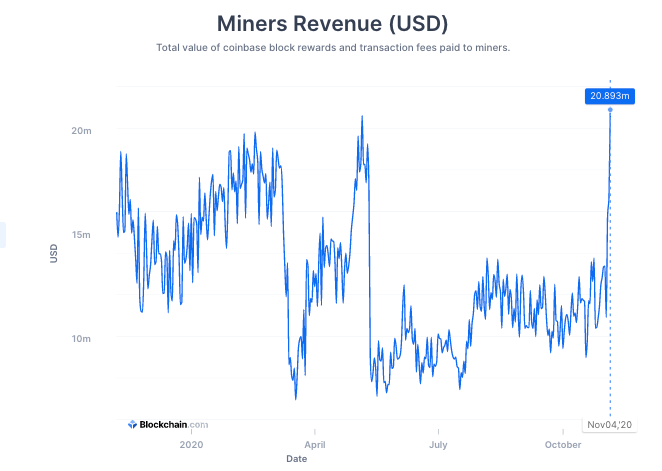

As the Bitcoin (BTC) price is reaching the highest levels since January 2018, Bitcoin mining is getting more profitable due to a number of factors. According to data from Blockchain.com, BTC miners revenue has soared to levels not seen since Bitcoin’s third halving in May 2020 that reduced the miner block reward from 12.5 BTC to 6.25 BTC.

As such, BTC miners’ revenue hit $20.8 million on Nov. 4. According to Blockchain.com, the highest point recorded since September 2019, when miners’ block reward was twice as much as now. A spike in BTC miner revenue levels is coming from Bitcoin price doubling since the May halving. On Nov. 4, Bitcoin price reached a new 2020 high at $15,950, jumping more than 20% over the past seven days.

The jump is also due to the simultaneous rise in Bitcoin transactions’ fees. As reported by Cointelegraph, Bitcoin transaction fees surged nearly 200% in late October. As such, the percentage of BTC miner revenue from fees has significantly increased, accounting for $4.15 million or roughly 20% of total miner revenue.

Amid parabolic growth in revenues, some miners are likely to start cashing out at this point. According to analysts at CryptoQuant, some miners may be compelled to start selling BTC since the Miner’s Position Index is currently at around 4. Values above 2 indicate that most miners are selling.

Additionally, there is also a noticeable spike in transactions from miners to exchanges as the price crossed above $15,000. However, the amount is still relatively small compared to pre-halving outflow levels.

Bitcoin miner revenue surges to pre-halving levels, CoinTelegraph, Nov 6