Bitcoin (BTC) saw its biggest negative difficulty adjustment in almost 10 years on Nov. 3 as the network flawlessly takes care of itself. Data from monitoring resource BTC.com shows that the Bitcoin difficulty automatically readjusted by 16% on Tuesday.

Estimates had previously suggested that the adjustment would be around 13%, but it was the second-highest in Bitcoin’s history. Only in 2011 was there a larger difference — 18%, which also came at the end of October. Difficulty adjustments happen automatically every 2016 blocks, and allow Bitcoin to remain as “hard” money regardless of any external factors impacting miners.

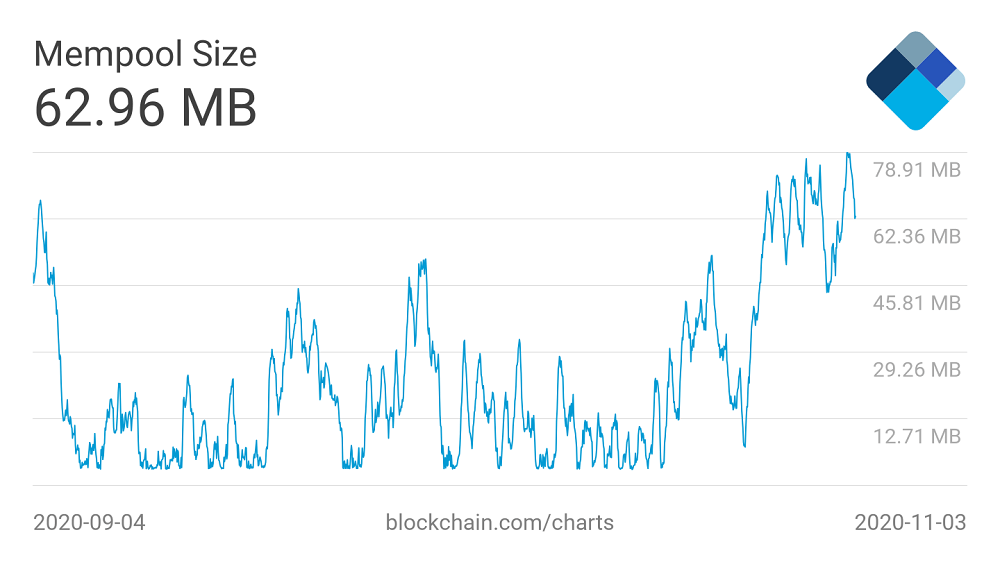

Such a reduction incentivizes more mining participants to compete for block subsidy rewards, with the result that the difficulty then begins to rise again. At press time, however, estimates put the next adjustment at another -16%, indicating that the effect of Tuesday’s event had not yet been felt. For users, the downward adjustment will reduce fees and decrease block times, along with reducing the size of unmined transactions in Bitcoin’s mempool. According to estimates from Earn.com, the optimal Bitcoin transaction fee remains high, at 80,000 satoshis ($11).

Commentators appeared only a little fazed, instead praising Satoshi Nakamoto’s design for protecting network and funds integrity. Meanwhile, Bitcoin’s network hash rate appeared to be u-turning on its own descent Tuesday, with estimated weekly average values beginning to trend up.

Bitcoin just had its biggest mining difficulty drop since 2011, CoinTelegraph, Nov 3