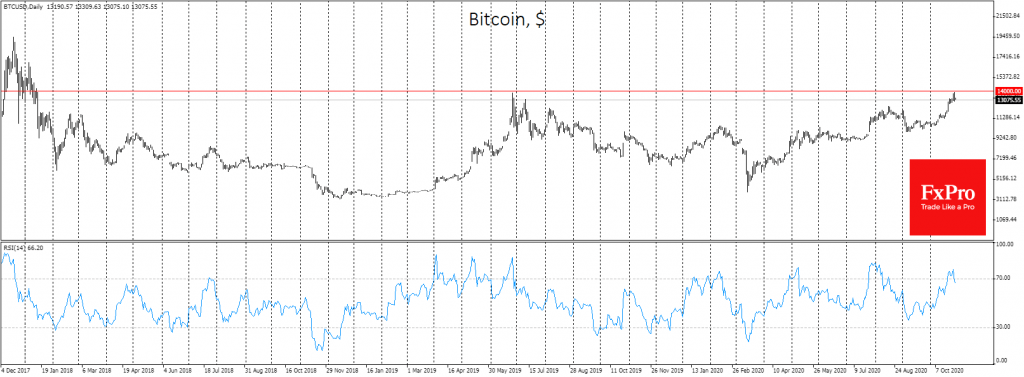

Bitcoin’s first attempt in three years to overcome $14K failed. Sellers intensified as the first cryptocurrency approached $13,800 due to the storm on the European and U.S. stock markets. However, the larger the Bitcoin correction, the more impressive the rebound could be, as there is a clear demand for discounts.

Despite a 4% decline overnight, Bitcoin is growing by 3% over the week. The Bitcoin dominance index has also increased by more than a percentage point over the week. Thus, investors are responding to a series of positive news about investments in Bitcoin by large companies in the traditional sector. The latest was the news about $300 million investment in Bitcoin from BlockFi, which was made through Grayscale.

At the moment, market participants are expecting the upcoming expiration of $450 million in Bitcoin options on Friday. According to CoinTelegraph, the bull to bear ratio is currently 3:1. Nevertheless, the potential increase in volatility may provoke increased pressure from the least optimistic investors. If the positive news background outweighs this and Bitcoin closes the week and month near $14K, it will clear the path to $20K.

The positive scenario is also supported by the Grayscale survey, the results of which showed that 55% of interviewed U.S. investors are interested in buying Bitcoin this year. This is 19% higher than a year ago.

The two-trillion dollar support package currently under discussion is capable of reviving demand not only in the stock market but also in cryptocurrencies, which proved to be a very profitable source of diversification of savings in 2020. As the popularity of Bitcoin grows, so does the cost of transactions. Recently one of the largest transactions worth $1.3 billion was recorded in the network (94.5K BTC) with a fee of only $3.5. However, as interest and trading volume grows, transaction fees increased on average from $3.5 to $10. Despite this, Ethereum (ETH) miners still earn more with stablecoins and DeFi.

According to Messari, as of October 25, ETH miners earned $1.74 million per day, while BTC miners earned $1.54 million. Although commissions are increasing, they still cause slight confusion, as they are infinitely more profitable for users in terms of commission levels and transaction speeds in the banking sector.

The FxPro Analyst Team