Market picture

Bitcoin jumped 24% last week to close at $28K. Ethereum added 16.2% to $1800. Other leading altcoins in the top 10 gained between 6.6% (Polkadot) and 19.3% (BNB).

The total capitalisation of the crypto market, according to CoinMarketCap, rose 14% over the week to $1.17 trillion.

Last week proved to be the best week for bitcoin in the last five years, since February 2018. BTC rose sharply along with gold as market participants began to see it as a safe haven for capital amid problems with banks.

At the same time, bitcoin’s positive traction has been boosted by technical factors. Having found itself in the $25K+ territory, the first cryptocurrency appears to be facing an impressive short squeeze.

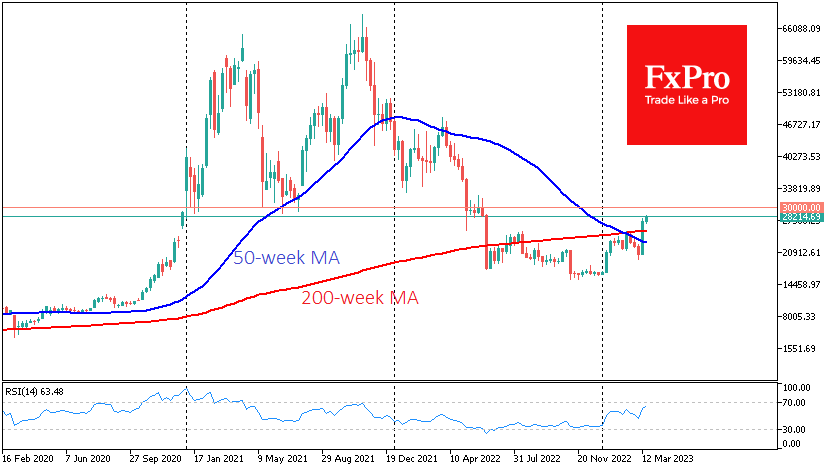

As is often the case with cryptocurrencies, they only become attractive to speculators after strong moves. The recent momentum still has some upside potential. The $30K area was a significant support for a year and a half until the middle of last year and now has a high chance of acting as resistance. As we approach the $30K level, we should be prepared for the bulls to start taking massive profits, much as we have seen since the second half of February.

News background

Ryan Selkis, CEO of analyst firm Messari, has predicted that the first cryptocurrency will hit $100K within 12 months. He sees bitcoin as a safe investment amid problems in the US economy.

Moody’s believes that the recent decoupling of USD Coin (USDC) from the US dollar could hinder the development of stablecoin and lead to tighter regulation.

Cryptocurrency exchange Coinbase is exploring the possibility of creating a new trading platform outside of US jurisdiction, Bloomberg reports. Launching an offshore exchange would allow Coinbase to insulate itself from hostile US regulation and offer international customers new products that are not approved in its home market.

Ethereum co-founder Vitalik Buterin has called for self-storage of digital assets. He said that he personally and the Ethereum Foundation use the MultiSig wallet to store most of their funds.

The FxPro Analyst Team