Market picture

Bitcoin changed little over the day, remaining near $19.1K as the external outlook turned bleak, but there was no positive change either. Ethereum is trading near $1300, but the top altcoins are mostly down, losing between 0.2% (Tron) and 5% (Cardano).

By Thursday, the cryptocurrency fear and greed index was unchanged at 20 points (“extreme fear”). The total capitalisation of the crypto market fell by 0.7% to $915bn overnight.

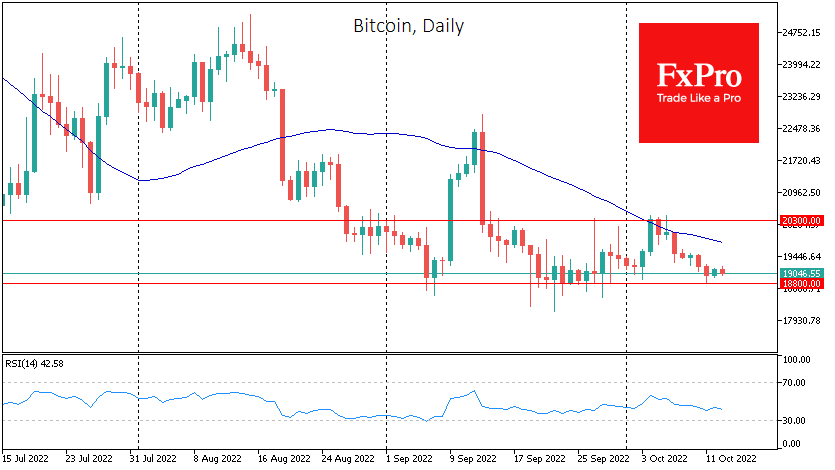

There is a lot of press attention on the US inflation data today, which could determine the Fed’s next move. This wait-and-see attitude leaves BTCUSD near the lower end of the trading range, from where we could see an explosion of volatility in either direction.

A sharp rise from current levels would dramatically increase the chances that the cryptocurrency bottom has already been passed in June. A step down from current levels could kick-start a decline into the $12-14K area.

News background

Arcane Research has warned that the ratio of Open Interest (OI) in bitcoin and Ethereum futures and perpetual contracts to their capitalisation indicated a likely sharp increase in volatility in the crypto market.

Major investment bank JPMorgan and payment processor Visa has announced the integration of blockchain solutions Liink and B2B Connect for fast international payments. Blockchain could make transactions fast and cheap and even compete with the SWIFT interbank payment system.

The island nation of Dominica in the Caribbean Sea has adopted Tron cryptocurrency as a legal tender in the country.

Lastly, the head of the Commodity Futures Trading Commission (CFTC), Rostin Benham, expressed his belief that bitcoin and Ethereum are commodities and warned the crypto industry that regulation is inevitable.

The FxPro Analyst Team