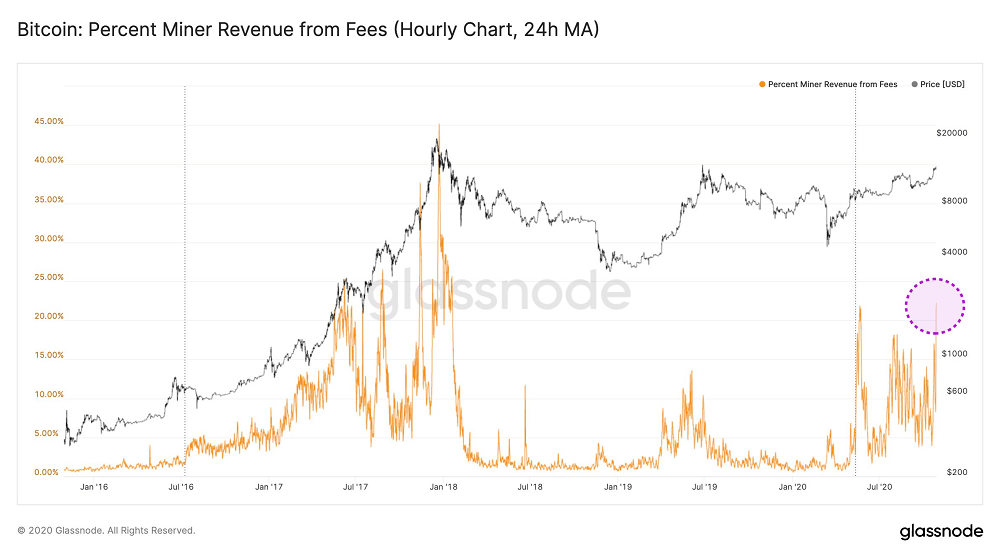

Bitcoin (BTC) transaction fees have nearly tripled in three days, from $3.52 to $10.20 on average. According to crypto market data aggregator Glassnode, 22.25% of Bitcoin miners’ income is currently made up of fees, with the other 77.75% coming from block rewards. The share of fee revenues is currently the highest it has been since the plateau of the last all-time high in January 2018 — which followed fee revenues spiking to almost a 45% share during the previous month.

The latest spike follows a jump in average daily Bitcoin fees in recent days, launching into double-figures in dollar terms for the only time except for the period between November 2017 and January 2018.

Despite the share of mining revenue represented by fees tripling in the past month for Bitcoin miners, Ethereum (ETH) miners are still raking in more fees. Ethereum fees recently outpaced those generated by Bitcoin for the longest streak ever, owing to stablecoin use and the exploding decentralized finance (DeFi) sector built on the Ethereum network.

After first overtaking Bitcoin on June 6, Ethereum’s fee revenue exceeded Bitcoin’s until Oct. 22, with two momentary exceptions at the end of July and the start of August.

While Bitcoin momentarily reclaimed its fee dominance last week, Ethereum’s fees have again been higher since Oct. 25. As of this writing, Ethereum fees totaled $1.74 million over the past 24 hours, compared to Bitcoin’s $1.54 million, according to Messari.

Bitcoin fees spike 198% but Ethereum still more profitable, CoinTelegraph, Oct 28