The price of bitcoin was able to hit as high as $19,920, according to CoinDesk 20 data, before momentum stalled. Traders began hitting the sell button, taking the price to as low as $18,171 before it recovered. It was at $19,123.70 as of press time.

Katie Stockton, a technical analyst for Fairlead Strategies, sees $19,511 as a “resistance” level, a price point the world’s oldest cryptocurrency can break through in this time of highly bullish sentiment. “An eventual breakout appears likely from a momentum perspective,” she said, noting that $19,511 “is not a strong resistance level – $20,000 is a psychological hurdle, much like Dow 30,000.”

Analysts are also keeping an eye on ether. The all-time high for the native currency of the Ethereum network is over $1,400 and many think the cryptocurrency is a good buy in this bull market.

“I think ETH is still undervalued versus BTC,” noted George Clayton, managing partner of investment firm Cryptanalysis Capital. “All this DeFi (decentralized finance) going on is showing the utility of smart contract protocols.”

Is bitcoin leading ether?

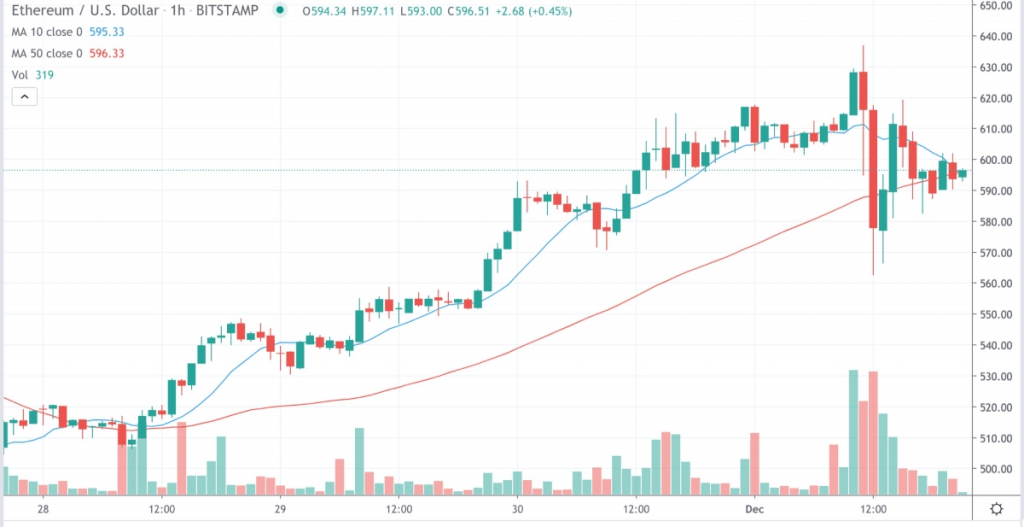

Ether (ETH), the second-largest cryptocurrency by market capitalization, was down Tuesday, trading around $596 and slipping 2% in 24 hours as of 21:15 UTC (4:15 p.m. ET).

Over the past several days, ether has mirrored bitcoin’s price rise closely. The correlation between bitcoin and ether is also trending upward, though is lower than it was after the March market meltdown.

The fact the two cryptocurrencies are increasingly trading in tandem belies the fact that Ethereum’s 2.0 Beacon Chain launch clearly differentiates some of its use case aspects. While bitcoin’s “store of value” narrative continues to be a strong signal coming from industry analysts, the “programmable money” thesis of Ethereum doesn’t seem to be making the market asset perform based on its own fundamentals – yet.

“Both assets have definitely seen a [U.S. dollar]-priced upswing, and though BTC has been the one to have a lot of recent news around its proximity to all time highs, Ethereum has been the real star of the summer of DeFi and into the fall compared to BTC,” noted John Willock, chief executive officer of crypto custody provider Tritium. “I believe that as confidence in 2.0 with some operating history and broader investor understanding of the economic implications to the valuation of ETH spreads, we will see a bull run in ETH,” he added.

Market Wrap: Bitcoin Falls to $18.1K as Correlation to Ether Picks Up, CoinDesk, Dec 2