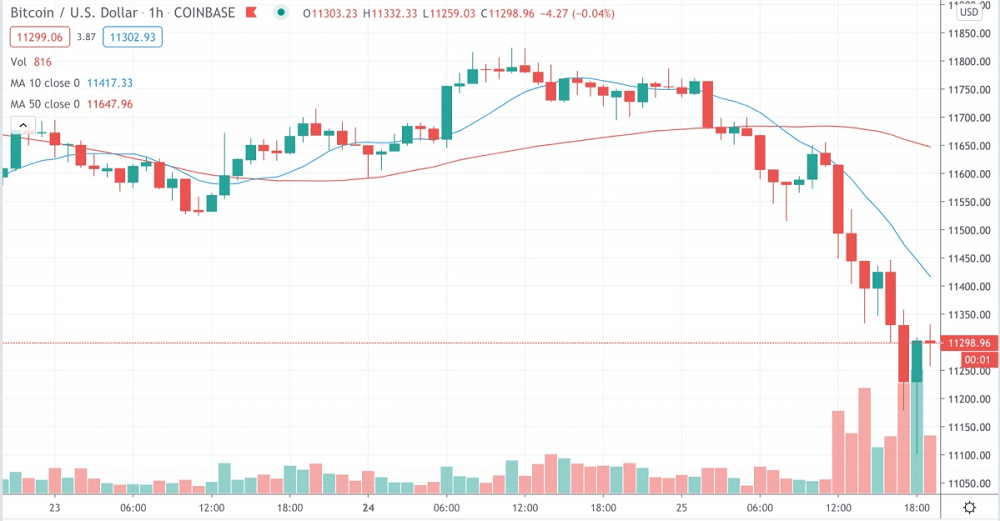

Bitcoin’s price declined to as low as $11,102 on spot exchanges such as Coinbase Tuesday, wiping out long derivatives traders on BitMEX. In just one hour, up to $5.6 million in leveraged positions were automatically liquidated, the crypto analog to a margin call.

Daniel Ladinsky, trader at quantitative trading firm Efficient Frontier, worries that if price stays beneath $12,000 per one BTC for too long it may signal a larger downward trend. “BTC has been hovering below $12,000 for quite some time, which is a crucial zone,” Ladinsky told CoinDesk.

One interesting development: Bitcoin locked in decentralized finance, or DeFi, is down a little bit after it had previously doubled in August, according to data aggregator DeFi Pulse.

Efficient Frontier’s Ladinsky says traders continue to see more alluring profit opportunities in DeFi, which might help explain the decline. “Recently, the market has been quiet for BTC and most of the attention and hype is on the DeFi front, where coins are surging very hard,“ he said.

The second-largest cryptocurrency by market capitalization, ether (ETH), was down Tuesday, trading around $379 and slipping 5.9% in 24 hours as of 20:00 UTC (4:00 p.m. ET).

Ethereum’s mining difficulty has hit a 2020 high, at 2,820 terahashes, its highest level since Dec. 13, 2019.

The amount of gas, or the fee required to successfully conduct a transaction or execute a contract on the Ethereum blockchain, is at an all-time high, meaning the resources used per block are increasing. This means more miner revenue coming from fees and, as a result, more machines being turned on, causing mining difficulty to increase.

Bitcoin Dips to $11.1K; Ether Mining Difficulty at Year High, CoinDesk, Aug 26