Market Overview

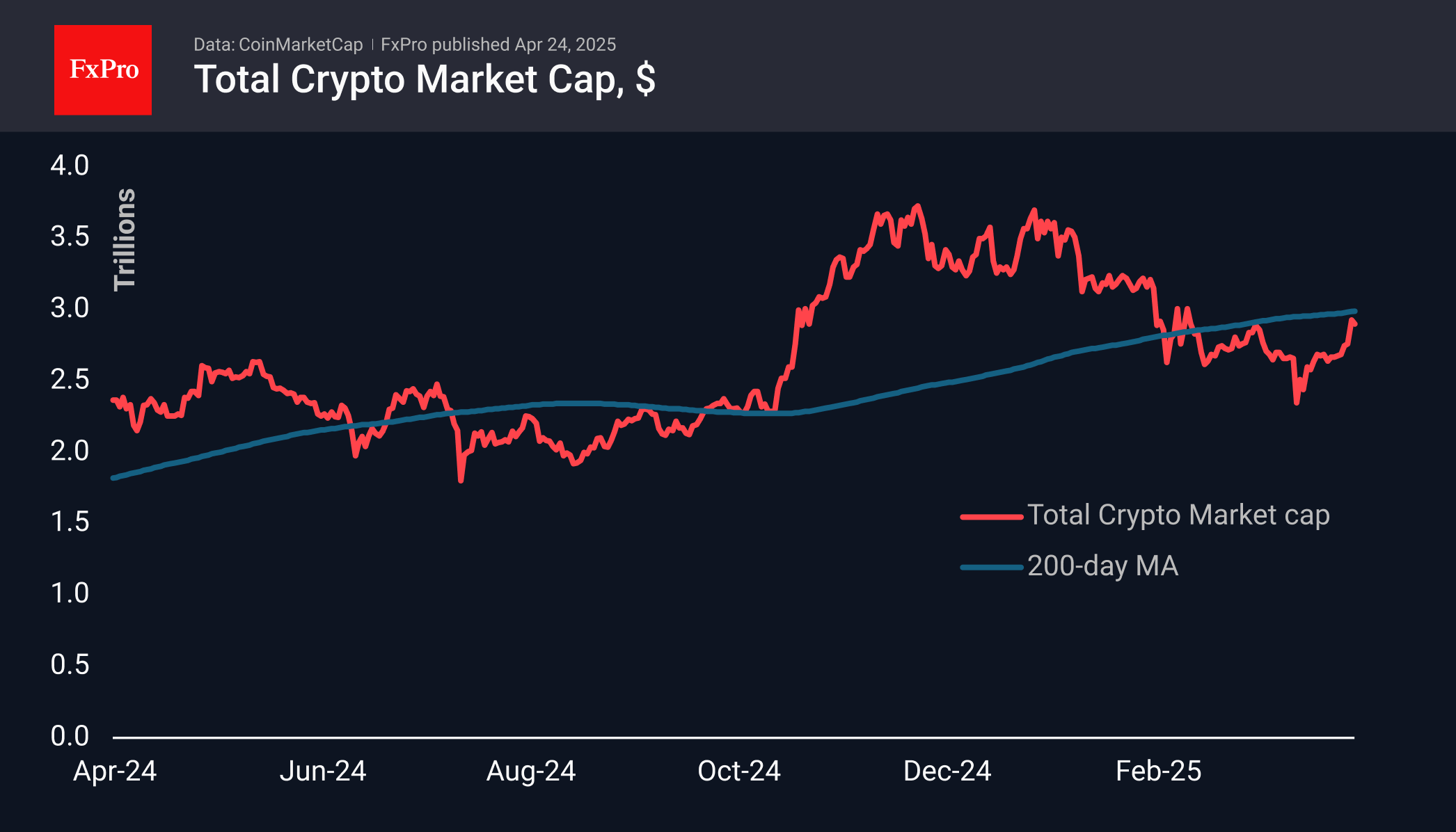

The cryptocurrency market has corrected about 1.3% to $2.9 trillion from Wednesday’s peak but has been steadily adding over 8.5% over the past seven days. The market is bouncing off the long-term key level of $2.5 trillion, which previously acted as a significant area of resistance. Capitalisation has surpassed the recent peak, marking the breakdown of the downward resistance of the last three months. This is an important signal of the market’s willingness to move further upwards.

Bitcoin was climbing towards the $94,000 area during the week, more than 20k above the low point at the start of April. Reaching the recent highs aligned perfectly with the 161.8% Fibonacci extension from the initial bounce, fitting neatly into the pattern.

At the same time, it suggests a new short-term consolidation phase before an upward spurt. The technical target for a potential new rise is at $106,000, which is near the area of the first cryptocurrency’s historical highs. If the Fibonacci pattern works, we will see a third test of these levels.

News Background

Trump’s change in rhetoric has fuelled enthusiasm in the cryptocurrency market. According to Velo, total open positions soared 10% to $17.83bn. Funding rates also sharply moved from negative to positive.

Bitcoin will continue to grow if threats to the Fed’s independence persist, Standard Chartered expects. In such a scenario, the first cryptocurrency will play the role of a decentralised hedge against traditional financial systems.

According to the Financial Times, financial company Cantor Fitzgerald intends to create a $3 billion investment fund in Bitcoin. SoftBank, Tether, and Bitfinex are involved in the project, which aims to create a ‘public alternative’ to Strategy.

Trump Media, the parent company of President Trump’s social network Truth Social, intends to launch a crypto-ETF together with Crypto.com and Yorkville firm America Digital. Already having regulatory approval, partners expect to launch Truth.Fi–branded products by the end of the year.

The FxPro Analyst Team