Bitcoin is making gains, though much of the day saw the cryptocurrency in a holding pattern. Meanwhile, a quarter of ether options are expiring in March, meaning traders are making some bets on the first fiscal quarter of 2021.

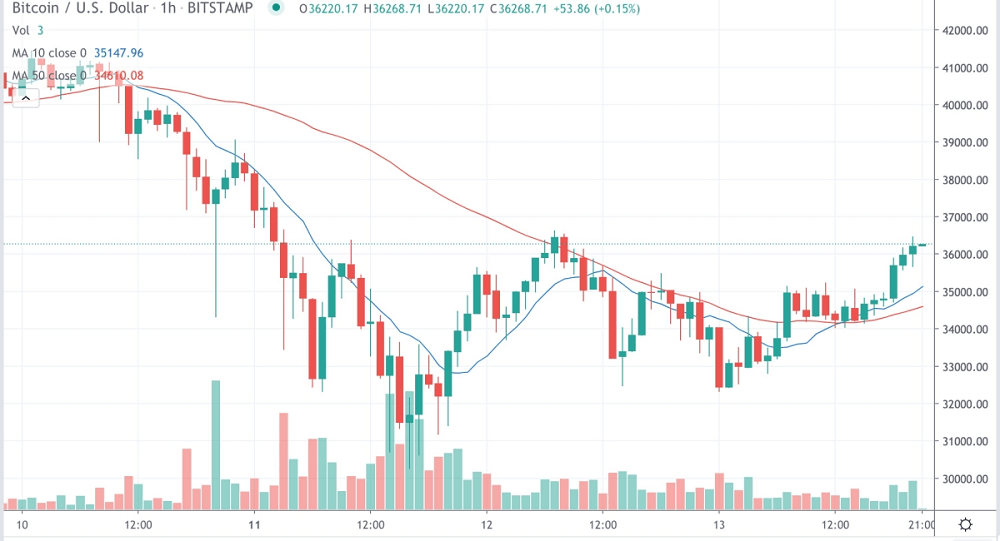

Bitcoin (BTC) trading around $36,286 as of 21:00 UTC (4 p.m. ET). Gaining 5.5% over the previous 24 hours. Bitcoin’s 24-hour range: $32,463-$36,552 (CoinDesk 20). BTC above the 10-hour and 50-hour moving averages on the hourly chart, a bullish signal for market technicians.

Bitcoin was able to recover from a drop in price Wednesday. After going as low as $32,463 around 01:00 UTC (8 p.m. ET Tuesday), it was able to stay in a $34,500-$35,000 range before breaking out to $36,464 before settling at $36,286 as of press time. Despite the past few hours of price gains, analysts refer to a day of little price action as a “sideways” or “flat” market. It’s not clear after so much excitement for the world’s oldest cryptocurrency in the first few days of 2021 what might happen next for the price, according to Misha Alefirenko, founder of crypto market maker VelvetFormula.

Bitcoin spot volumes were clearly taking a breather after Monday’s record-high daily zenith of $13.5 billion for the eight exchanges tracked by the CoinDesk 20. For Wednesday, the tally was at $4 billion as of press time, closer to the past month’s $3.8 billion daily spot average.

Market Wrap: Bitcoin Claws Back to $36.4K While 25% of Ether Options Will Expire in March, CoinDesk, Jan 14