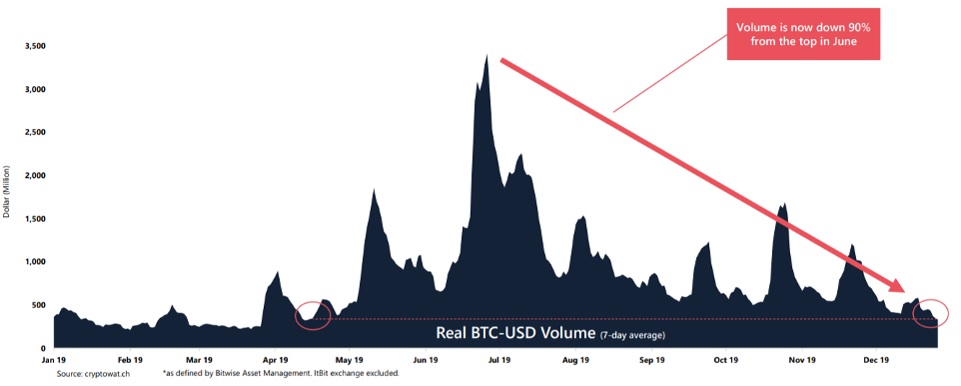

Bitcoin and cryptocurrency bulls have cheered bitcoin’s more-or-less positive start to 2020, despite the rise coming off the back of a major escalation in tensions between the U.S. and Iran. The bitcoin price, which limped through December following six months of declines, dropped below the psychological $7,000 per bitcoin mark early in the new year only to bounce back again a few hours later. However, crypto analysts have warned bitcoin trading volume is now at its lowest since April, with volume down 90% from its June 2019 high—and when volume is low markets are more likely to make sudden, volatile moves.

“The seven-day average real trading volume continued downwards this week,” analysts at Arcane Research wrote this week. “The first day of the year registered as little as $192 million in volume. These levels have not been seen since April 2019. Although this could be related to the holiday period and less activity during weekends, this is not a positive trend for the leading cryptocurrency in the space.”

Bitcoin trading volumes are now almost back to the level they were at the beginning of 2019—when the bitcoin price was under $4,000. However, there are a number of upcoming dates in 2020 that could see bitcoin interest return to July levels, including the planned launch of Facebook’s libra cryptocurrency, crypto platform Bakkt’s Starbucks project, and bitcoin’s May halving event—when the number of new bitcoin rewarded to miners will be halved.