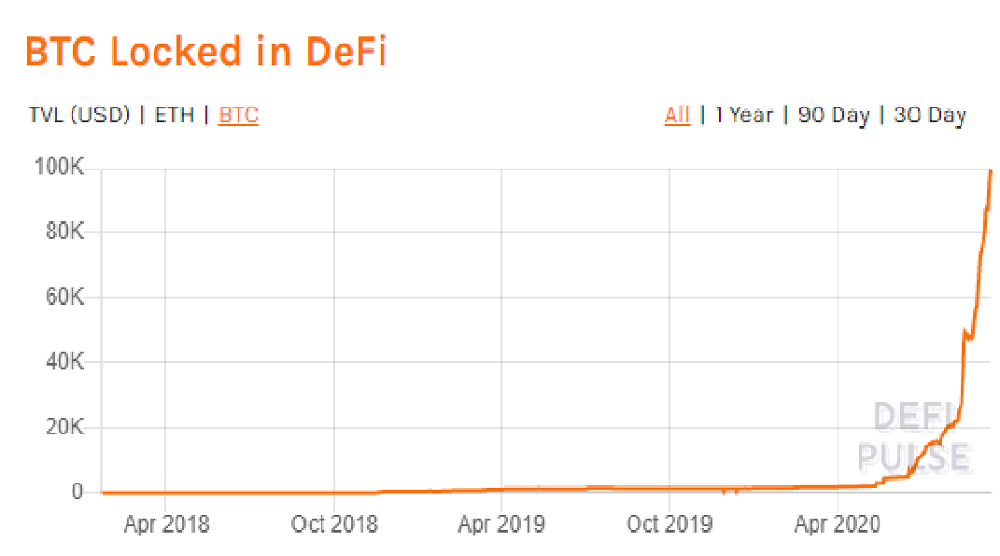

More than $1 billion worth of Bitcoin (BTC) has now been tokenized to access decentralized finance (DeFi) protocols on the Ethereum (ETH) network. That’s equivalent to the entire total value locked (TVL) in DeFi less than four months ago. According to DeFi Pulse, roughly 98,300 BTC, worth $1.05 billion, has been tokenized using protocols other than Blockstream’s Lightning Network — equating to more than 12% of the DeFi’s sector’s $8.57 billion combined capitalization.

The milestone illustrates the increasing popularity of ETH-based protocols for generating passive returns among Bitcoin hodlers, with the entire DeFi sector having been valued at just $1.05 billion TVL as of the start of June — of which $47.5 million or 4.7% was Bitcoin, indicating that the share of DeFi’s capitalization represented by BTC has increased by 150% over three and a half months.

By contrast, the Lightning Network has only attracted 1,100 Bitcoin worth $11.5 million since launching during March 2018. While both protocols have more than doubled in the number of locked Bitcoin over 30 days, WBTC continues to attract a larger volume of BTC than Ren — with WBTC growing from roughly 28,360 BTC to 56,850 BTC, and RenBTC expanding from 10,000 BTC to 21,510 over one month.

Over the past 90 days, both projects have grown by more than 850%. On June 19 WBTC represented only 5,839 BTC and Ren had tokenized just 155 BTC.

In June, the vast majority of BTC in the DeFi sector took the form of Wrapped Bitcoin (WBTC), However, the launch of Ren’s more decentralized Virtual Machine (VM) and RenBTC in addition to grassroots tokenization protocols like PieDAO’s BTC++ this year have boosted Bitcoin’s expansion into DeFi.

Bitcoin tokenization protocols let users lock up their Bitcoin and mint an corresponding ERC-20 token — allowing the value represented by a user’s Bitcoin holding to interact with smart contracts on the Ethereum network.

More than $1B in Bitcoin has been tokenized for DeFi, CoinTelegraph, Sep 15