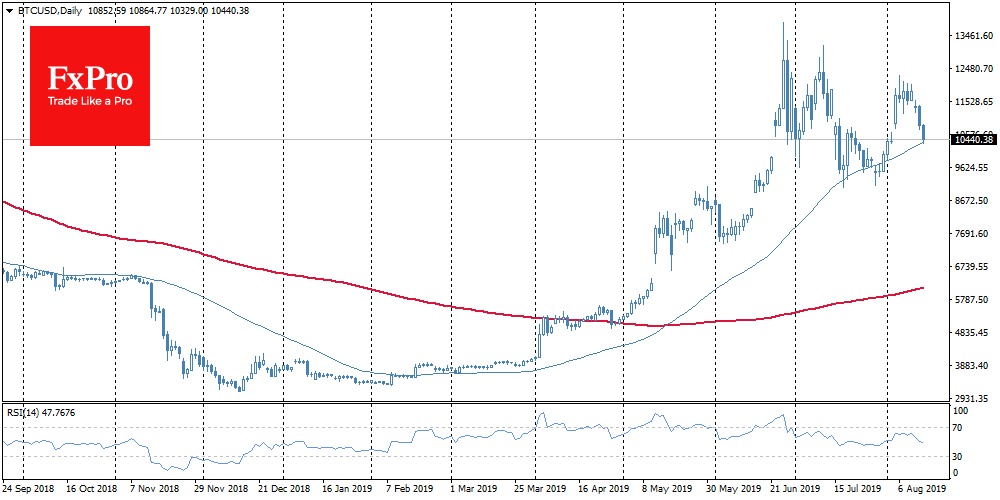

The BTC has fallen by almost $800 or 7% per day and trades on Wednesday morning for $10,600. What does not grow – it falls. A very actual phrase about Bitcoin at the moment. The inability to develop the growth resulted in the decline of Bitcoin.

Market participants are once again talking about the correlation with the stock market, pointing to the increased demand for bitcoin at the decline of the indexes due to the tightening of the situation around the trade war and the inverse dynamics when the situation is softening. Nevertheless, such a theory has a lot of opponents who point to simple speculative laws in the formation of the price of a benchmark cryptocurrency.

Many technical analysts also spoke about the exhaustion of the bullish impulse, referring to the multiple failures of bulls around $13K, and then $12K. In any case, several important support levels were broken through at once, which opens new opportunities for bears.

The FxPro Analyst Team