Binance Research, the research arm of the world’s largest crypto exchange, claims that President Donald Trump caused the latest bitcoin price spike. Binance Research made the specious claim on Twitter, where it noted: “BTC has rallied, together with multiple safe-haven assets, after Trump’s latest tariff storm. Will the trade war continue to be a catalyst for Bitcoin price growth?”

The implication is that mounting geopolitical uncertainty is causing investors to seek refuge in “safe haven assets” such as gold and U.S. Treasury bills. Safe haven assets are believed to offer protection against stock market downturns. Because of its over-the-top volatility, bitcoin is not widely accepted as “safe haven” asset.

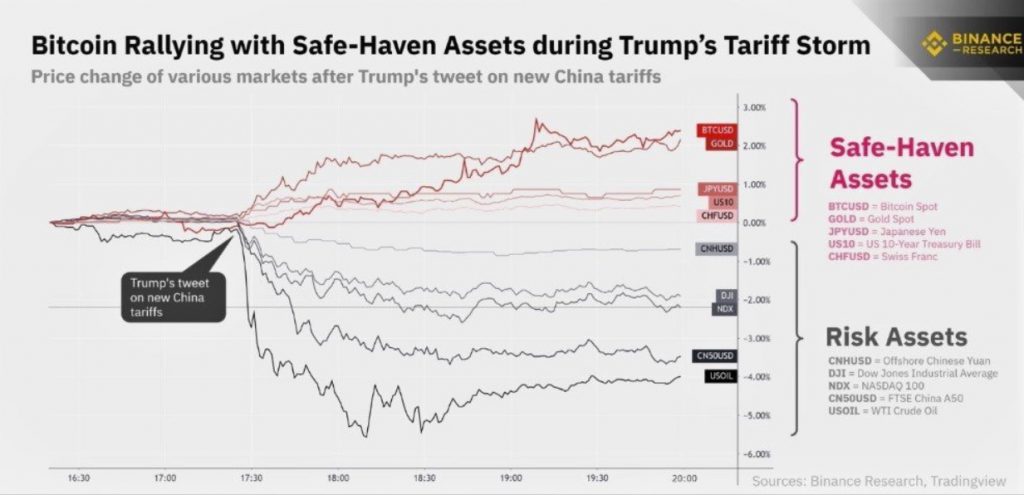

To buttress its claims, Binance tweeted a chart that apparently showed a correlation in the price movements of bitcoin, gold, the 10-year U.S. Treasury bill, and “safe haven” currencies such as the Swiss franc. Most people know that correlation is not causation. However, Binance tried to tie Trump’s trade rhetoric to rising bitcoin prices. It offered no other evidence to support this flimsy contention.

Binance Research’s claim aligns somewhat with the statements of its CEO, Changpeng Zhao. Last week, Zhao told CNBC that Trump’s criticism of cryptocurrencies is extremely bullish for the industry. CZ says Trump’s tweets dramatically raised bitcoin’s global profile by forcing the public and the mainstream media to discuss crypto.