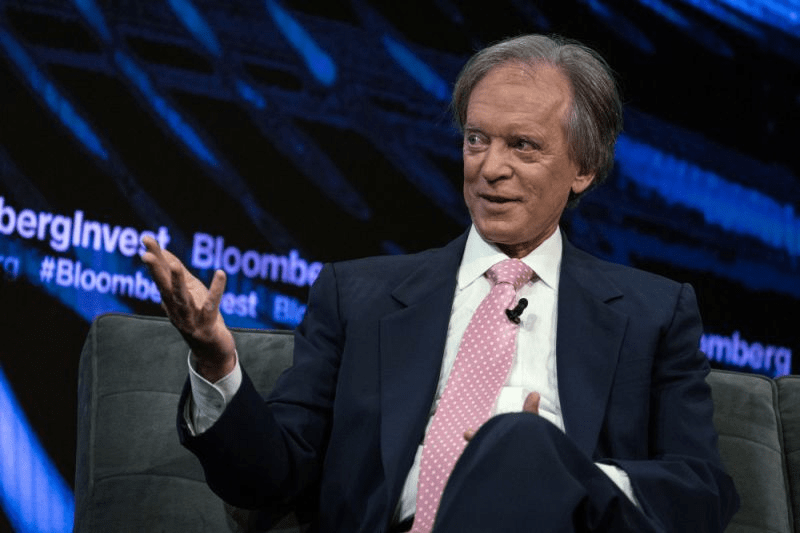

Investors should be shifting into shunned sectors such as tobacco, banks and European stocks as fiscal stimulus and the stomach for growing deficits in the U.S. wane, according to longtime money manager Bill Gross. With an emphasis on defense, investors should consider assets that haven’t “skyrocketed on dreams of back-to-normal economic prosperity followed by even lower artificial real interest rates,” Gross, who retired last year, said in an outlook released Monday.

“There is little money to be made almost anywhere in the world — Covid 19 vaccine or no,” wrote Gross, who co-founded Pacific Investment Management Co. and later worked for Janus Henderson Group Plc.

Gross favors value stocks that pay healthy dividends, and says investors should consider using leverage to amplify returns. Central banks are unlikely to raise interest rates in the foreseeable future, lowering the risk a leverage trade would backfire, Gross said in an interview on Bloomberg television Monday. “You’ve got to lever,” he said. “You’ve got to be able to borrow.”

Bill Gross Says Investors Should Play Defense as Stimulus Ebbs, Bloomberg, Sep 15