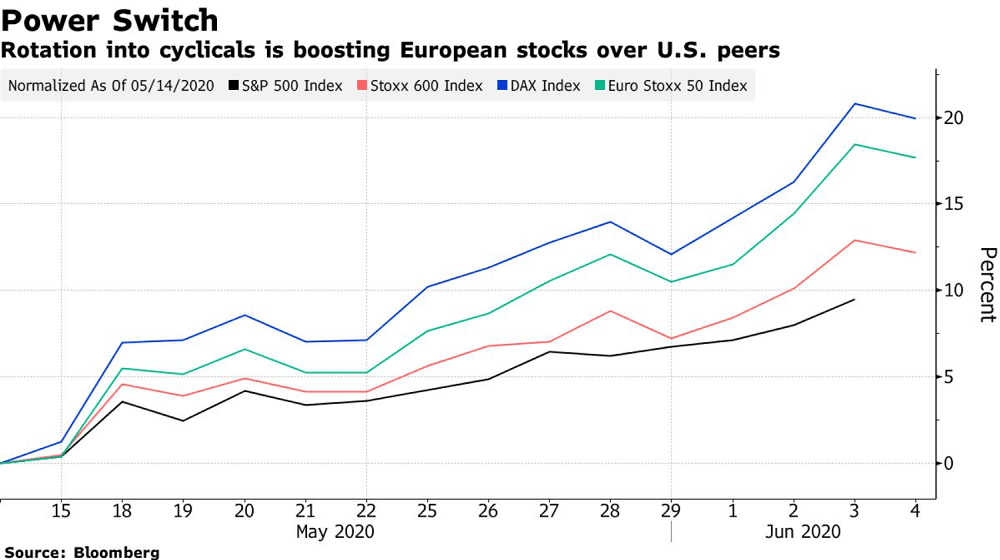

In a switch from the longer-term trend, European equities are beating their U.S. peers in the latest leg of the rebound. Boosted by a strong outperformance of cyclical shares on bets of a swift economic recovery and after a string of stimulus plans, the Stoxx Europe 600 Index has rallied 12% since mid-May, versus 9% for the S&P 500 Index.

The difference is even starker when looking at Germany’s DAX Index, with its heavy weighting of carmakers and industrial shares. The benchmark, which includes dividends, has surged 19%, more than twice the gain for the U.S. gauge. Other euro-area markets have also been strong, with France’s CAC 40 up 17% and Italy’s FTSE MIB up 16%.

While the rebound in equities paused in early May on bleak economic and corporate updates as well as rekindled U.S.-China tensions, the mood has turned buoyant in recent weeks as European countries started to reopen economies. Investors are also widely anticipating further measures from the European Central Bank.

Some shares that were hard-hit in the rout which began in late February are also rebounding strongly: European shopping center landlord Hammerson Plc, which slumped to a record low amid the impact from the pandemic, has surged 175% since May 14, while tourism company TUI AG has jumped 89%.

That’s boosted the relative performance of Europe, which has lagged the U.S. for the past four years despite repeated bullish calls from strategists. European equities are still trailing so far in 2020, however, with the Stoxx 600 down 12% year-to-date, versus a loss of 3.3% for the S&P 500 over the period.

Believe It or Not, Europe Is Finally Outperforming Wall Street, Bloomberg, Jun 4