Stock markets made some developments on Monday: American indices added more than 1%, while Asian markets are also echoing the American momentum on positive signals of international trade. Reports of commitment to Phase 1 and further negotiations as well as a statement of an EU-US trade tariff reductions helped markets to reach new levels.

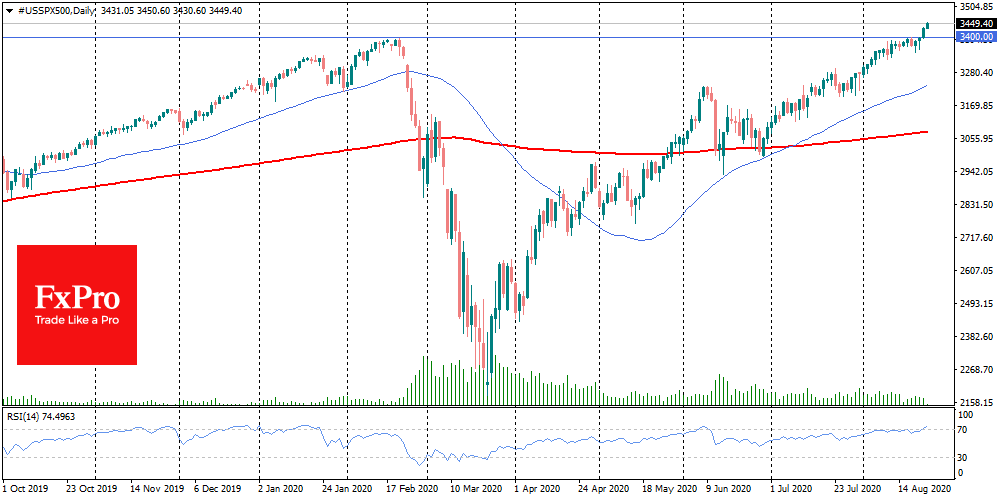

It is also worth paying attention to the general change in market sentiment. Earlier this month, the S&P 500 was long attempting to reach historic highs. The Dow Jones Index showed a moderate but steady decline from the 11th to 20th August, which also encouraged caution.

But by the end of that week, buyers returned to the market, breaking the correction mood. It seems that the idea of growing markets, with an economy that has not fully recovered, is becoming increasingly mainstream.

A huge layer of short positions on the most popular stocks and indices was wiped away under the pressure of stimulus and recovery of economic indicators.

As a result, last week there was a record low of open short positions on S&P500, since at least 2004. This week’s rise in the index is likely to wipe out even more.

Tesla, the bear’s favourite stock, has the lowest open sell interest in nine years.

This summer’s market rally has hit traders with a different opinion than normal, forming a consensus on the growth of the stock market. The influential Jim O’Neill calls August a month that should be watched closely, as the trends of August set the tone for the rest of the year. And so far, we have witnessed all-mighty optimism.

There is also a downside to open short positions. Without the shorts being forced to close, there will be no sharp bursts in stocks and indices. The market can now be ruled by profit-taking after previously catching the growth.

Apart from closing short positions, it is also worth noting that trading volumes in August are lower than usual. Investors often return to the markets after a sluggish June and July but now there is a smooth decline in contrast to the growth of indices.

The question of what may happen next can be answered by a return to the foreign exchange market. The growth of the dollar from current levels will reveal the cautious mood of markets towards the prospects of a risk asset rally. Renewed pressure on the USD and a reversal upwards on EURUSD promises to strike at the bears yet again.

The FxPro Analyst Team