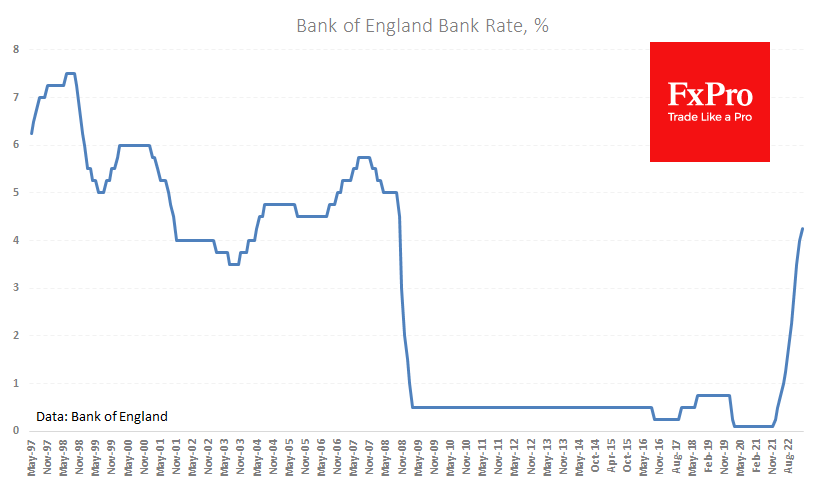

The Bank of England raised its interest rate by 25 points to 4.25%, in line with market expectations. Two members voted to keep rates on hold for the third meeting, while seven others voted against it.

Commenting on the decision, the BoE noted the improved global growth outlook and now expects UK GDP to grow in the second quarter, up from a 0.4% contraction previously. Separately, the fall in gas and oil futures prices is noted.

The Bank of England has described the recent unexpected rise in inflation as temporary and continues to see a significant slowdown over the year. This is in no small part due to the current budget changes.

The Bank of England said further policy tightening might be needed if there is evidence of additional inflationary pressures in wages and services costs. This sounds like relatively dovish commentary, expressing more hope than confidence in a sustained return of inflation to the 2% target and the financial sector’s resilience. Indirectly, the regulator’s rhetoric suggests that the baseline scenario remains for rates to stay on hold.

GBPUSD initially reacted positively to the rate decision, returning to the day’s high of 1.2340, but at the time of writing has pulled back below 1.2300. At the same time, the Pound’s momentum against the Dollar is primarily driven by the Dollar. In our view, the GBPUSD completed an almost three-month correction in early March, with the next target near the upper end of the trading range since December at 1.2430. Likely, the strengthening will not stop there, and the pair will have further strength to reach a new level, targeting 1.30.

The FxPro Analyst Team