If you want to see how important interest rate expectations are to FX, look at the reaction of the Pound and the Dollar after their central bank meetings. The Bank of England raised rates by 75 points on Thursday, repeating a similar move by the Fed less than a day earlier. In both cases, we heard warnings about the growing chances of a recession and, against all odds, the intention to proceed with a hike.

The fundamental difference, in our view, was that the Fed made it clear yesterday that the final rate would be higher than expected. The markets were expecting to see a peak rate near 4.75%-5.00%. And now they are leaning towards the upper end of that range. At least, that is the interpretation that prevails in the media now.

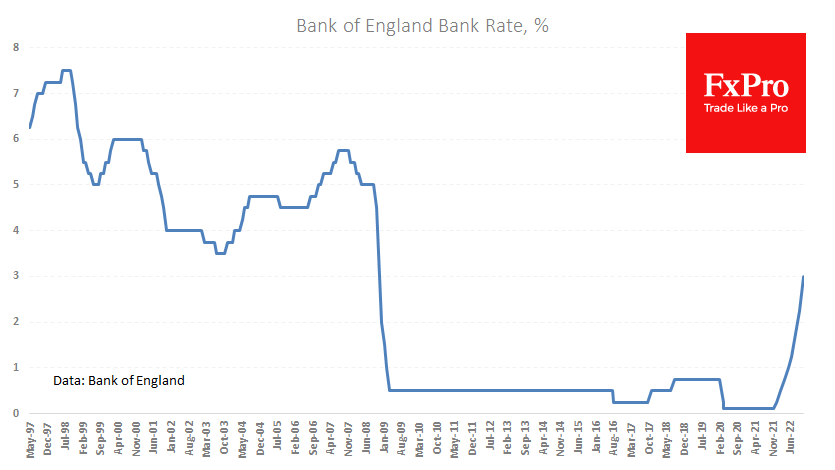

The Bank of England, on the other hand, has warned that a peak rate could be lower than the current market expectation of 5.25%. This was enough to take another 0.8% off GBPUSD, bringing the overall decline to 3.5% from the peak after the Fed’s comments at 1.1560 to the bottom at 1.1160.

Last week the GBPUSD strengthening stalled on the rise above 1.1600. Yesterday’s drop broke the pair’s nascent upward trend, potentially depreciating it to a rebound within a down-trend.

The FxPro Analyst Team